The pound has certainly been beaten, most recently by the impact of the Brussels bombings. What’s next? The team at Goldman Sachs weighs in:

Here is their view, courtesy of eFXnews:

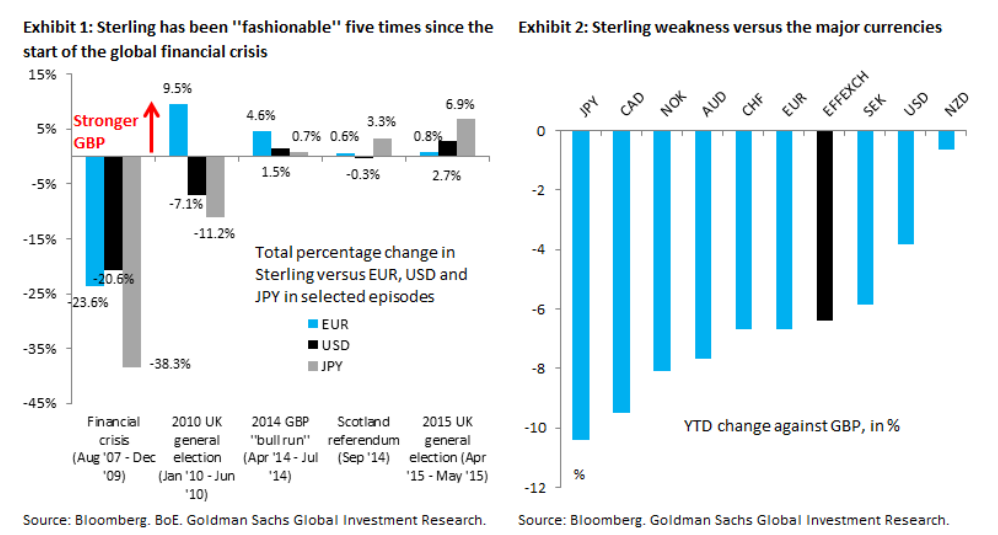

According to research conducted by the Bank of England, Sterling has been “fashionable” and has driven movements in G-10 FX five times since the start of the Global Financial Crisis . In the year to date, Sterling has already weakened significantly versus the major currencies.

But we think GBP downside has not yet run its course and that the Pound will be “the story” among foreign investors for the remainder of the year.

Given heightened uncertainty over the outcome of the UK’s referendum on EU membership, we expect a period of Sterling weakness from now until June 23. This is likely to be followed by (i) a period of GBP strength if UK voters choose to remain members of the European Union, in line with our Economists’ base case, or (ii) a period of depreciation if Brexit becomes a reality. Either way, given how difficult it is to forecast this event, much of the price action will come after the fact. Past the date of the referendum, sterling is likely to remain a “fashionable” and “actionable” currency.

We focus mainly on our base case that the UK will remain a member of the EU. Indeed, we think it is important not to lose sight of the UK’s solid economic performance and its implications for the Bank of England’s policy and the currency.

Although the GBP may not move against the major currencies as much as it would if Brexit were to become a reality, the price action would still offer opportunities if it doesn’t.

After a 3%-5% cable downside in the run-up to the referendum(from 1.42 to 1.37), we expect approximately a 4% appreciation and forecast GBP/$ at 1.40 in 12 months.

But, if the UK remains a member of the European Union, the Pound would likely move significantly stronger against the EUR in H2 and beyond: on our forecast currently we expect 15% Sterling upside over a 12-month period.

…Short cable is our preferred implementation of the weak Sterling view in the event of a Brexit. Long positions in EUR/GBP are much less convincing, given that Brexit would not be good news for the rest of Europe.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.