Keeping up with his poll promise to hold a referendum whether to stay ‘In’ or ‘Out’ of the EU, British PM David Cameron concluded a three day marathon meeting in Brussels with his EU counterparts. Concluding the negotiations, it seemed like Britain managed to get what it wanted. ‘Special Status’ recognition in the EU, alongside a few other items related to welfare benefits and finance with a bit of compromises in between.

Heading back to the UK, Mr. Cameron announced that he would be campaigning for the UK to stay in the EU while announcing June 23rd 2016 as the date for the referendum. In just a few hours later, he was met with a lot of resistance both from his opposition and within his own party ranks. At the time of writing, the Brexit ‘Out’ campaigners are clearly in the majority, exposing a serious risk of Britain voting to leave the EU.

At the core of the debate is the rising Euro-skepticism across continental Europe and within the UK itself following crisis after crisis which has engulfed the European Union. If last year was all about ‘Grexit’ then 2016 is certainly going to be the year of ‘Brexit’

While many arguments have been made, both for and against the UK staying in the EU, the onus falls to the British citizens both in the UK and abroad who will have a say on June 23rd whether they want the UK to be part of the EU or not.

The geo-political uncertainty has made the British Pound quite vulnerable and with the referendum date being confirmed on June 23rd the currency could see further volatility, including the Euro to a certain extent.

A Brexit could potentially threaten not just the British Pound but the Euro as well, where the UK is a strong contributing economy to the economic bloc.

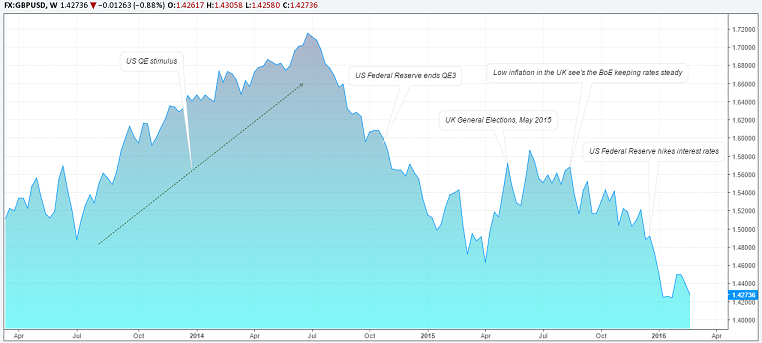

GBPUSD, which only last year was trading above the $1.55 handle started its descent, plagued by the uncertainty surrounding the UK general elections last year in May and falling expectations of a BoE rate hike. The Cable declined -5.42% in 2015 and on a year to date basis, the currency is already down -3.12%, trading near the lows of 1.42, last seen in 2009.

Between now and June 23rd, the political landscape could change a lot. However, one constant remains, which is uncertainty. And when the markets are uncertain about an outcome, ‘Selling’ makes for the most ideal strategy as the GBPUSD witnessed over the past weeks where any rallies were met with strong resistance pushing prices even lower.

Traders should however bear in mind that the Brexit uncertainty is not a binary outcome. Even if the UK does manage to leave the EU, there are various models going around which hint at a more loose cooperation such as that of the Swiss or Norway. Despite a break from the EU, chances are that the UK could still manage to move ahead, although at this point in time, the markets are only focusing on whether the UK will stay In or Out of the EU.

In summary, the following macro fundamentals are currently at play as far as the GBPUSD is concerned.

• BoE expected to hold rates steady at 0.50% into 2016 year end

• BoE officials have turned dovish in recent months including talks of negative interest rates

• US Federal Reserve on the other hand has managed to get away with one rate hike so far, and markets expect at least another rate hike in 2016

• Low inflation in the UK is expected to remain into 2017

• Brexit keeps the uncertainty putting GBPUSD at risk to the downside

Guest post by Andreas Pavli of http://www.AllFxBrokers.com