The New Zealand dollar followed its Australian peer in decline today as the market sentiment was not particularly good for currencies associated with higher risk. Risk aversion caused by mixed economic data released from China over the weekend pushed the kiwi lower, the same as the Aussie. Additionally, last week’s surprise interest rate cut from the Reserve Bank of New Zealand continues to weigh on the currency. It will be interesting … “NZ Dollar Follows Australian Peer in Decline”

Month: March 2016

Australian Dollar Trades Lower

The Australian dollar traded lower against the US dollar and the Japanese yen today after risk aversion hit the market following the release of mixed macroeconomic data from China over the weekend. China’s industrial production rose 5.4% in January and February from a year ago, slower than the analysts’ prediction of 5.6%. Fixed investment was up 10.2%, beating the forecast of 9.5%. Retail sales also grew 10.2%, yet this indicator … “Australian Dollar Trades Lower”

Greenback Mostly Higher Ahead of Data

US dollar is mostly higher today, thanks to a certain level of risk aversion. Stocks are struggling and there are concerns about the economies in China and the eurozone. Economic data for the United States is expected throughout this week, and some Forex traders are waiting to see what it shows. Greenback is getting a bump against its high beta counterparts in Forex trading today. There is a lot of … “Greenback Mostly Higher Ahead of Data”

Yen Higher on Safe Haven Demand, More Stimulus Could Come

Japanese yen is higher today, thanks in large part to safe haven demand. However, this may not last. The Bank of Japan is expected to continue stimulus in April. Yen is higher against most of its counterparts today. A great deal of uncertainty is causing demand for safe haven assets. Stocks are lower and concerns about the economies around the world are weighing on high beta currencies. As a result, that … “Yen Higher on Safe Haven Demand, More Stimulus Could Come”

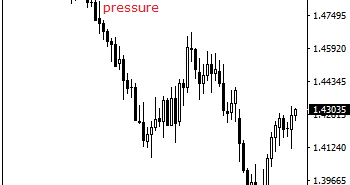

GBPUSD: Bull Pressure To Target The 1.4400 Level

GBPUSD: The pair remains biased to the upside on corrective recovery leaving risk of more strength on the cards. On the downside, support lies at the 1.4250 level where a break will turn attention to the 1.4200 level. Further down, support lies at the 1.4150 level. Below here will set the stage for more weakness … “GBPUSD: Bull Pressure To Target The 1.4400 Level”

CAD: Rebound Going Too Far – CIBC

The Canadian dollar rallied hard and was only temporarily moved by weak employment figures. Has it gone too far? Here is their view, courtesy of eFXnews: We’ve had evidence that a weak C$ finally started lifting manufacturing shipments, export volumes and GDP generally towards the end of last year. However, the strong rebound in the … “CAD: Rebound Going Too Far – CIBC”

Euro Ends Week Higher Against Most Rivals

The most important event for the past trading week was considered to be the policy meeting of the European Central Bank, and it indeed did not disappoint, both fulfilling market expectations and surprising markets at the same time. Traders were expecting the ECB to announce stimulus measures, and the central bank did indeed deliver. Yet the surprise came in the form of Mario Draghi’s suggestion that the ECB is likely to end interest rate cuts. This … “Euro Ends Week Higher Against Most Rivals”

Pound Ends Trading with Gains

The Great Britain pound has ended today’s trading with gains against its most-traded rivals after the release of domestic economic reports that were relatively good. The UK trade balance deficit shrank a bit from £10.5 billion in December 2015 to £10.3 billion in January 2016. Construction output fell 0.2% in January from December, but the drop was not nearly as big as the predicted 1.3%. All in all, fundamentals … “Pound Ends Trading with Gains”

NZ Dollar Joins Other Commodity Currencies in Rally

The New Zealand dollar gained today, joining other commodity currencies in a rally. Poor domestic macroeconomic reports did little to dissuade it from rising. Gains of crude resulted in a good performance for currencies linked to raw materials, and the kiwi was not different. The drop of manufacturing index and the decline of food prices were unable to prevent the advance of the currency. The NZ dollar still ended the week with losses, but they were far … “NZ Dollar Joins Other Commodity Currencies in Rally”

Dollar Mixed as Markets Feel Secure

Today, the US dollar was weaker against the Great Britain pound and commodity currencies but gained on the euro and the Japanese yen. The currency’s moves were mostly driven by the positive market sentiment. The traders’ mood was relatively optimistic by the weekend. The major contributors to the optimism was yesterday’s announcement of stimulus measures by the European Central Bank and today’s decision by the People’s Bank of China to set the mid-range point for the yuan higher. The rally of crude oil helped … “Dollar Mixed as Markets Feel Secure”