The Canadian dollar rallied today in spite of rather poor employment data released from Canada. The apparent reason for the currency’s strength was the gains of crude oil. Canada’s employment dropped by 2,300 in February instead of rising by 10,200 as analysts had predicted. The unemployment rate ticked up from 7.2% to 7.3% unexpectedly. Yet all the negative data did not prevent the loonie from rising. The currency remains strongly correlated with oil prices, … “Canadian Dollar Withstands Impact of Poor Employment Report”

Month: March 2016

EUR/USD: Turning Bullish; Range & Outlook – BTMU

The ECB gave a lot but it was not enough. What’s next? The team at BTMU sees the bullish side: Here is their view, courtesy of eFXnews: The euro has strengthened sharply following the ECB’s announcement of more aggressive easing, notes BTMU. “The counter intuitive reaction sends a bullish signal for the outlook for the … “EUR/USD: Turning Bullish; Range & Outlook – BTMU”

EUR/USD: Don’t Expect Downside To Resume Now: Here Is

The ECB delivered a lot, but nothing is enough for the euro. What’s next? Here is the view from BNP Paribas: Here is their view, courtesy of eFXnews: The ECB delivered significant easing measures on Thursday, lowering its depo rate by 10bp, cutting its refi rate by 5bp, increasing the run rate of asset purchases, … “EUR/USD: Don’t Expect Downside To Resume Now: Here Is”

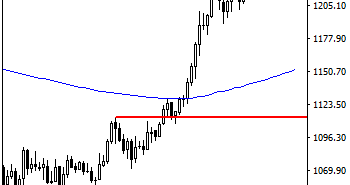

GOLD Faces Further Bullish Momentum On Rally

GOLD: Having closed higher and seen following through during early trading today, GOLD faces further sees bullish momentum. On the downside, support comes in at the 1,270.00 level where a break will turn attention to the 1,260.00 level. Further down, a cut through here will open the door for a move lower towards the 1,250.00 … “GOLD Faces Further Bullish Momentum On Rally”

Euro Bounces After Initial Losses During Volatile Session

Today’s trading session was very volatile for the Forex market due to the monetary policy meeting of the European Central Bank. The euro sank immediately after the gathering but bounced afterwards. Most market participants were expecting additional stimulus from the ECB and the central bank did not disappoint. It reduced all its interest rates, including the key rate which has been cut to zero — a huge surprise to the market. Additionally, … “Euro Bounces After Initial Losses During Volatile Session”

ECB: Emptying Mario’s Cart – CIBC

Fresh off the wild EUR/USD moves on the big ECB decision, here is the view from CIBC: Here is their view, courtesy of eFXnews: Having failed to live up to expectations late last year, the ECB today stepped up with stimulus that actually went beyond what was anticipated. The cut in the deposit rate further into … “ECB: Emptying Mario’s Cart – CIBC”

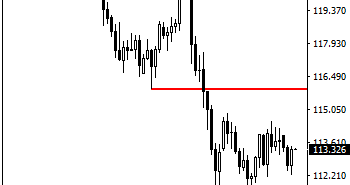

USDJPY: Remains On Recovery Offensive

USDJPY: With the pair reversing its Tuesday losses on Wednesday, further bullishness is likely. On the downside, support comes in at the 112.50 level where a break if seen will aim at the 112.00 level. A cut through here will turn focus to the 111.50 level and possibly lower towards the 111.00 level. On the … “USDJPY: Remains On Recovery Offensive”

Bank of Canada Holds, Makes Canadian Dollar Stronger

The Canadian central bank left its interest rates stable during the Wednesday’s policy meeting, surprising no one. The Canadian dollar jumped as a result and kept its gains during the early Thursday’s trading hours. Unlike the Reserve Bank of New Zealand, the BoC did not provide any surprises to the market, leaving its key interest rate at 0.5%. The bank sounded rather confident in the state of the global economy: The global economy is … “Bank of Canada Holds, Makes Canadian Dollar Stronger”

RBNZ Surprises Market Cutting Interest Rates, Kiwi Goes South

The Reserve Bank of New Zealand caught the market by surprise, slashing its benchmark Official Cash Rate today. The New Zealand dollar dropped more than 1% immediately after the announcement. The RBNZ cut its main interest rate by 25 basis points to 2.25% by the end of the Wednesday’s session. It was a total surprise to market participants as they were counting on the monetary policy to remain the same. Furthermore, RBNZ Governor Graeme Wheeler … “RBNZ Surprises Market Cutting Interest Rates, Kiwi Goes South”

Draghi expected to do even more, Outlook for Bund,

‘Draghi’, and ‘Why people are opting for bonds’ are the key topics in today’s discussion with Nicole Elliott, Private Investor and Technical Analyst, when she joined Zak Mir, Technical Analyst for Zaks Traders Cafe, and Mike Ingram, Strategist for BGC Partners, on the Tip TV Finance Show. Key Points: “2-yr government paper Schatz: Yields are … “Draghi expected to do even more, Outlook for Bund,”