The Japanese yen was firmer today as Haruhiko Kuroda, Bank of Japan Governor, downplayed prospects for additional monetary stimulus from the central bank. Kuroda signaled during today’s speech that he wants to assess the impact of the current extremely accommodative policy on the economy before acting again: I’d likely to carefully examine how the effects of [the 0.1% negative deposit rate] will filter through to the real economy. Furthermore, he admitted that … “Yen Firmer as Kuroda Downplays Stimulus Prospects”

Month: March 2016

AUD Opens Sharply Lower, Recovers

The Australian dollar opened sharply lower today from the Friday’s close as China slashed its growth outlook. As of now, the currency recovered a bit and is trading close to or above the Friday’s closing level. China announced that it is targeting 6.5%-7.0% growth for 2016. Markets met the announcement with mixed reaction. The news was rather pessimistic, but it was countered by optimism for stimulus measures that the country is likely … “AUD Opens Sharply Lower, Recovers”

USD/CAD: 2 BOC Previews

Here are two previews towards the decision of the Bank of Canada on Wednesday. Is there room for a dovish surprise? Here is their view, courtesy of eFXnews: Room For A Dovish BoC Surprise Next Week; Risk-Reward Favors Short CAD – BofA Merrill The Bank of Canada (BoC) held rates at 0.50% in January, despite expectations … “USD/CAD: 2 BOC Previews”

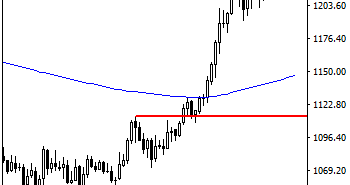

GOLD: Vulnerable Below The 1263/79 Zone

GOLD: With GOLD closing higher the past week (see weekly chart), further strength is expected. However, while it trades below the 1263.00/1279.00 resistance zone, risk of a move lower is likely. On the downside, support comes in at the 1250.00 level where a break will turn attention to the 1240.00 level. Further down, a cut … “GOLD: Vulnerable Below The 1263/79 Zone”

Trading ECB: Scenarios For EUR/USD – Goldman Sachs

The decision of the ECB is just around the corner. How will it affect the euro? Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: We lay out scenarios for EUR/$ for different outcomes on Thursday. Above all, after a year of mixed messages, the ECB needs to signal that it is … “Trading ECB: Scenarios For EUR/USD – Goldman Sachs”

How can social assist conversion

One of the biggest conversion hurdles a brokerage faces is a trader’s fear of the unknown. A newbie trader who has zero knowledge of the Forex trading market may be hesitant to make a first deposit, but with social trading, a brokerage can ease a new trader’s fear and put him on the track to … “How can social assist conversion”

Policy Outlook & Economic Data Make Things Difficult for USD

The US dollar managed to end the week flat against the Japanese yen, but otherwise the greenback was very weak during the past trading week. The reasons for the poor performance were the monetary policy outlook as well as macroeconomic data that was not that great. Economic reports released over the week were not good for the most part. The most important of them, non-farm payrolls, was not bad but also not … “Policy Outlook & Economic Data Make Things Difficult for USD”

Canadian Dollar Finds Support in Woes of US Rival

The Canadian dollar bounced after the initial drop today. While domestic fundamentals were somewhat beneficial, the main reason for the bounce was the decline of the US dollar. The positive side of Canada’s economic data released today came in the form of the trade balance deficit that increased just marginally in January while experts had predicted a much bigger increase. The negative part of the story came from the Ivey PMI that dropped in February much … “Canadian Dollar Finds Support in Woes of US Rival”

Non-Farm Payrolls Fail to Boost US Dollar

The US dollar was mostly weaker today (though it gained on the Japanese yen) despite the release of seemingly solid employment data that should have boosted the currency. The dollar showed a confusing reaction to non-farm payrolls, rising at first but falling back very quickly. It might look surprising that the greenback did not welcome the strong jobs growth. But as it often happens, the devil is in the details. The problem … “Non-Farm Payrolls Fail to Boost US Dollar”

Euro Bounces a Little, But Risks Remain

Euro is seeing some gains today, surging ahead, even though the US just posted solid jobs report for February and there are still downside risks to the 19-nation currency. Euro is higher today, even though it seems counterintuitive. The United States just released its February jobs report, showing that employment is surging. As a result, many are once again considering the idea that the Fed … “Euro Bounces a Little, But Risks Remain”