Canadian dollar saw some measure of recovery yesterday, thanks in large part to recovering oil prices. Today the loonie is struggling again, falling as Forex traders consider the future of the Canadian economy, and as some engage in profit taking. Oil prices have been heading a little bit higher in recent weeks. Since the Canadian dollar’s 13-low in January, the currency has seen a fairly decent gain, especially against the US dollar. It’s … “Loonie Falls Back After Yesterday’s Gains”

Month: March 2016

Pound Mixed After UK Data Disappoints

The Great Britain pound fell against the euro today due to poor UK economic data and fears of the Brexit. Nevertheless, the sterling was able to gain on such major rivals as the US dollar and the Japanese yen. The Markit/CIPS UK Services PMI fell to the lowest level since March 2013, missing market expectations by a wide margin. Analysts speculated that fears of the Brexit contributed to the decline. Adding to concerns, the seasonally adjusted Halifax house price … “Pound Mixed After UK Data Disappoints”

US Dollar Lower, Hurt by Macroeconomic Data

Macroeconomic reports released from the United States over the current trading session were mostly bad, leading to weakness of the US dollar against its major counterparts. The Markit services index fell below the neutral 50.0 level, indicating decline of the sector, for the first time in almost two and a half years. While the ISM services report showed a better picture as the index stayed above 50.0, the employment component of the data demonstrated contraction — a disturbing … “US Dollar Lower, Hurt by Macroeconomic Data”

Market Sentiment Beneficial to Indonesian Rupiah

The Indonesian rupiah rallied to the highest level in about five months today as the market sentiment was positive and helpful to currencies of emerging markets. The doubts about the ability of the Federal Reserve to raise interest rates this year led to the weakness of the US dollar and inflows into emerging markets. China’s central bank added stimulus this week by cutting reserve requirements for banks, and this also helped the sentiment. All in all, fundamentals were favoring … “Market Sentiment Beneficial to Indonesian Rupiah”

Domestic & Global Fundamentals Helpful to Australian Dollar

The Australian dollar rose today, reaching the three-month high against the US dollar and the euro, as both domestic and global fundamentals were beneficial to the currency. Australia’s trade deficit narrowed in January while the service sector halted its decline as the index rose above the neutral 50.0 level. Released yesterday, the gross domestic product report showed that the Australian economy grew in December quarter faster than analysts had anticipated. Meanwhile, crude … “Domestic & Global Fundamentals Helpful to Australian Dollar”

EUR/USD: A Replay Of December? – Credit Suisse

Expectations are becoming sky high towards the upcoming ECB decision on March 10th. Will we see the euro extend its falls like in January 2015 or bounce big time like in December 2015? The team at Credit Suisse has a clear opinion: Here is their view, courtesy of eFXnews: EURUSD’s decline in the past three … “EUR/USD: A Replay Of December? – Credit Suisse”

EUR/USD: Trading the US NFP March 2016

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP March 2016”

The Brexit and Spread Betting: Dynamic Market Interaction

The United Kingdom will be holding a referendum on June 23 to determine whether a Brexit will become a reality or not. Market volatility is approaching a crescendo. Spread betting activity is increasing in the lead up to the Brexit referendum! UK Spread Betting Enterprises Brace for Bumper Start to 2016 Foreign currency brokers and … “The Brexit and Spread Betting: Dynamic Market Interaction”

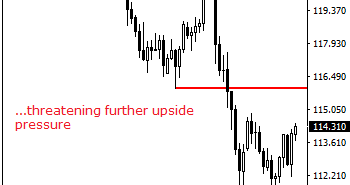

USDJPY: Reverses Higher With Eyes On Price Extension

USDJPY: With the pair taking back its Monday losses to close higher on Tuesday, further upside pressure is now underway. This development leaves the pair targeting the 114.86 resistance zone. On the downside, support comes in at the 113.50 level where a break if seen will aim at the 113.00 level. A cut through here … “USDJPY: Reverses Higher With Eyes On Price Extension”

USD Comeback – 3 Reasons – Credit Agricole

Recent figures in the US haven’t been too bad. Is the greenback making a big comeback? The team at Credit Agricole examines: Here is their view, courtesy of eFXnews: The USD-decoupling trade is staging a return on the back of improving US data, the abatement of global risk aversion and the growing resilience of the … “USD Comeback – 3 Reasons – Credit Agricole”