Eurozone policymakers are indicating that more easing could be in the future. An ECB meeting is scheduled for next week, and the odds that even looser monetary policy is coming are higher than ever. Comments made by Benoit Coeure in recent days are being taken as an indication that the ECB is truly getting ready to move forward with more monetary easing. Couere pointed out that many banks … “Euro Continues to Decline on Signals of More Easing”

Month: March 2016

GBP/USD: Trading the UK Services PMI

UK Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on … “GBP/USD: Trading the UK Services PMI”

Strongest Seasonal FX Patterns In March – ANZ

Every month has its own tendency, with patterns often repeating themselves. What can we expect from March? Here are the views from ANZ: Here is their view, courtesy of eFXnews: While short USD/CAD and long USD/JPY tend to perform well during the month of March, they are not attractive seasonal plays from a risk/reward perspective, … “Strongest Seasonal FX Patterns In March – ANZ”

US Dollar Trades Mixed as ISM Data is Released

Greenback is trading mixed today as the latest ISM data is released. The US dollar is down against sterling, but up against the euro and the yen. The dollar index is also higher today. The latest ISM data showed an improvement to 49.5 in February, up from January’s reading of 48.2. This still marks several months of being below the 50.0 mark, but there is still improvement. While the news is … “US Dollar Trades Mixed as ISM Data is Released”

Yen Retreats, Finds Little Help from China’s Poor Manufacturing Data

The Japanese yen fell today, retreating from the highest level in almost three years against the euro, even though poor manufacturing data from China, both official and private, was detrimental to investors’ risk appetite. Both official and private Caixin reports showed that China’s manufacturing sector continued to deteriorate in February. While the news has had some impact on markets initially, it was short-lived, and now traders feel … “Yen Retreats, Finds Little Help from China’s Poor Manufacturing Data”

ECB Meeting: Markets expecting a further rate cut and

Marc Ostwald, Strategist for ADM Investor Services, joined Zak Mir and Alan Green on the Tip TV Finance Show to discuss what is expected from the ECB Meeting next week, as well as the overall manufacturing state of the global economy, and a focus on the US. Topics Covered: ECB, Interest Rates, QE, Inflation, Manufacturing, … “ECB Meeting: Markets expecting a further rate cut and”

Aussie Higher After Reserve Bank of Australia Holds

The Australian dollar edged higher today following the monetary policy policy meeting of Australia’s central bank. The currency shrugged off negative economic data, both domestic and overseas. The Reserve Bank of Australia left its key interest rate unchanged at 2%, surprising no one. The bank suggested in the statement that policy easing is still possible: Continued low inflation would provide scope for easier policy, should that be … “Aussie Higher After Reserve Bank of Australia Holds”

Forex Crunch Key Metrics – February 2016

The month of February saw a slide from January, and also lower figures in comparison to last year. Looking around, this phenomenon was also seen elsewhere. Nevertheless, it require examination also in this neck of the woods. Here are the numbers: Website: Page Views: 399,797. Visits: 201,048. Visitors: 122,426. Time on Site: 1:52. Average Pageviews/Visit: 1.99 Bounce Rate: … “Forex Crunch Key Metrics – February 2016”

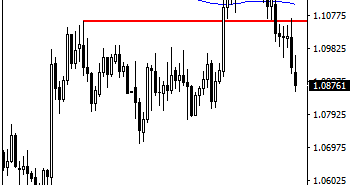

EURUSD Faces Further Downside Pressure On Bearishness

EURUSD: With EURUSD continuing to maintain its downside pressure, further weakness is envisage in the days ahead. Support lies at the 1.0950 level. Further down, support lies at the 1.0800 level where a violation will aim at the 1.0750 level. A break of here will aim at the 1.0700 level. Its daily RSI is bearish … “EURUSD Faces Further Downside Pressure On Bearishness”