The main theme of the Wednesday’s trading session was the monetary policy meeting of the Federal Reserve. The Fed managed to surprise the market even as it has left the policy stable. The US central bank kept its target interest rate at the 0.25%-0.50% range. Yet the important thing was that it lowered the expected path of interest rate increases in the future, predicting just two hikes by a quarter of a point this year instead of the previous prediction … “Dollar Crashes as Fed Lowers Interest Rate Expectations”

Month: March 2016

5 Dovish Points in the Fed Decision

The dollar totally tanked on the Fed decision. Was it the dot plot that crashed the greenback? Not exactly, that’s only one reason in a generally dovish statement that seems to contradict quite a few recent developments. What does the Fed know that we don’t? Here are 5 dovish points in the decision that explain the downfall … “5 Dovish Points in the Fed Decision”

Two more FOMC previews – Get ready

The Fed decision is coming shortly. Here are last minute views from Deutsche Bank and Credit Agricole. Stay tuned for our live coverage. Here goes. Here is their view, courtesy of eFXnews: How The FX Market Will Likely React To Today’s FOMC? – Credit Agricole The outcome of the March Fed meeting is the main event … “Two more FOMC previews – Get ready”

Euro Trades Mixed as Policymakers Wait for Fed to Make Move

Euro is trading mixed today, heading lower against the dollar by gaining against the yen and pound. For the most part, European policymakers are waiting for the Fed to make a move. As long as the Federal Reserve doesn’t raise rates, moves by the European Central Bank are less effective. It’s been a strange a few weeks for the euro. Even though more quantitative easing has been announced, and even though ECB president Mario Draghi … “Euro Trades Mixed as Policymakers Wait for Fed to Make Move”

Greenback Higher Ahead of Fed Announcement

US dollar is higher today, ahead of the federal reserve announcement later. Economic data in the United States continues to be solid. That is giving some analysts reason to believe the Federal Reserve will hike rates sometime in 2016. However, that day is probably not today. Greenback is higher pretty much across the board today against its major counterparts. This comes as the Federal Reserve is … “Greenback Higher Ahead of Fed Announcement”

Aussie Withstands Impact of Falling Leading Index

The Australian dollar hold steady against the US dollar and ticked up against other majors, like the Japanese yen. The falling leading indicators did not hurt the currency much. The Aussie behaved similarly to the kiwi, demonstrating decent performance, even though domestic fundamentals were not helpful to the currency. The Westpac-Melbourne Institute leading index fell by 0.15 points in February. Tomorrow, an employment report will be released, and analysts predict that … “Aussie Withstands Impact of Falling Leading Index”

NZD Flat vs. USD, Higher vs. JPY

The New Zealand dollar was flat against its US counterpart while rising against some other major currencies (including the Japanese yen) today. Economic data released from New Zealand was mixed. On the negative side, the GlobalDairyTrade Price Index demonstrated a drop by 2.9% yesterday — a bad sign for the New Zealand economy, which strongly depends on exports of dairy products. On the positive side, the current account deficit shrank to NZ$2.61 … “NZD Flat vs. USD, Higher vs. JPY”

Long USD Into FOMC: Here Is The Best Risk-Reward Trade

The big event of the week is coming today: the Fed decision. While no rate hike is expected, markets seem to be sitting on the edge of the chair in anticipation. What’s next? Goldman Sachs have a clear view: Here is their view, courtesy of eFXnews: With the US economy continuing to grow above trend, … “Long USD Into FOMC: Here Is The Best Risk-Reward Trade”

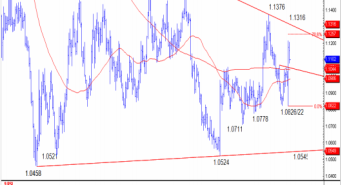

EUR/USD: Point Of Breakout Key: Levels & Targets –

EUR/USD is trading in a very narrow range ahead of the Fed, still digesting Draghi. What do the charts tell us? Here is the view from Credit Suisse: Here is their view, courtesy of eFXnews: EUR/USD spotlight remains on the “point of breakout” and 200- day average at 1.1068/44, notes Credit Suisse. “We look for this … “EUR/USD: Point Of Breakout Key: Levels & Targets –”

AUD/USD: Trading the Australian Employment Change

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 00:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian Employment Change”