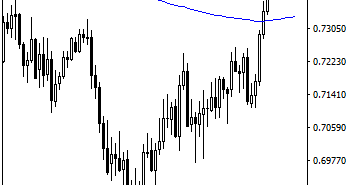

The Australian dollar fell today after the Reserve Bank of Australia released minutes of its latest monetary policy meeting. The notes suggested possibility of an interest rate cut. The RBA released minutes of its March 1st meeting where the central bank left monetary policy unchanged. Members of the Board had a lengthy discussion of the global economic slowdown and its possible impact on Australia. The discussion concluded with a suggestion of a possible reduction of interest rates … “Aussie Falls After RBA Minutes Suggest Possibility of Interest Rate Cut”

Month: March 2016

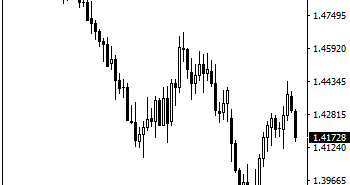

GBPUSD: Sells Off On Price Weakness

GBPUSD: The pair followed through lower on the back of its Monday losses on Tuesday. This development leaves GBPUSD threatening further downside pressure in the days ahead. On the downside, support lies at the 1.4250 level where a break will turn attention to the 1.4200 level. Further down, support lies at the 1.4150 level. Below … “GBPUSD: Sells Off On Price Weakness”

Yen Rallies After BoJ Makes No Move

The Japanese yen rallied today as the Bank of Japan decided to keep its monetary policy unchanged, a decision that had been widely anticipated. The BoJ made no surprise keeping its monetary policy stable during today’s meeting. The central bank noted in the statement a possibility of additional monetary easing, saying that it would “take additional easing measures in terms of three dimensions — quantity, quality, and the interest rate — if it … “Yen Rallies After BoJ Makes No Move”

Sterling Falls With Stocks

UK pound is losing ground today as global stocks drop. Concerns about the UK economy also continue to weigh on the sterling. Global stock markets continue to fall today, and that is having a negative impact on the UK pound. Sterling is often affected by the performance of the stock market. It is no surprise that with global stocks struggling the UK pound the following suit. Falling stocks are especially influential … “Sterling Falls With Stocks”

Admiral Markets makes big changes in trading conditions

Forex broker Admiral Markets will significantly change trading conditions from March 28th. This including different spreads, leverage levels and other changes. Here is more information from the official press release: From the session opening Monday March 28 2016, Admiral Markets CFDs on indices and commodities will be more: accessible, via reduced margin requirements and contract … “Admiral Markets makes big changes in trading conditions”

CFI Markets joins WRC as Official Forex Trading Partner

Forex broker CFI Markets has officially joined the World Rally Championship as the official forex partner. Here is more information from the official press release: WRC Promoter agrees partnership with CFI Markets CFI Markets becomes Official Forex Trading Partner of FIA World Rally Championship CFI Markets is one of the leading online FX and CFDs trading … “CFI Markets joins WRC as Official Forex Trading Partner”

EUR: Drivers & Trading Strategy For Next 3 Months –

The ECB’s huge stimulus package backfired and sent EUR/USD higher, but can this last? There are also other factors in play for the common currency. Here is the view from Nomura: Here is their view, courtesy of eFXnews: Over the next three months or so, EUR trading will likely depend on three factors: i) efficacy of the … “EUR: Drivers & Trading Strategy For Next 3 Months –”

GBP/USD: Trading the UK Average Earnings Index

UK Average Earnings Index, released each month, is a leading indicator of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Wednesday at 9:30 GMT. Indicator Background The Average Earnings Index measures wage growth and is closely watched by … “GBP/USD: Trading the UK Average Earnings Index”

AUDUSD: Weakens, Sees Corrective Pullback Risk

AUDUSD. Having the pair capped its strength at 0.7593 level to close lower on Monday, a move further lower is now underway. On the downside, support resides at the 0.7450 level where a breach will aim at the 0.7400 level. Below that level will set the stage for a run at the 0.7350 level with … “AUDUSD: Weakens, Sees Corrective Pullback Risk”

3 reasons to sell EUR/USD – structural bearishness

EUR/USD is beginning to climb down the Draghi-backfire tree but around 1.11, it still remains elevated. The team at Morgan Stanley explain why they expect further downside. Here are their 3 reasons: Here is their view, courtesy of eFXnews: We remain bearish on EUR on a structural basis, looking for a move to parity against USD … “3 reasons to sell EUR/USD – structural bearishness”