While Draghi certainly provides some dramas, rocking and rolling markets, the main driver of sentiment is oil. The black gold affects stocks, other commodities and currencies – not only commodity currencies. What does imply for the trend moving forward? The team at SocGen explains.

Here is their view, courtesy of eFXnews:

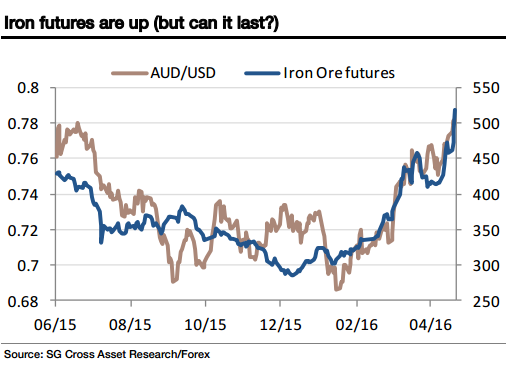

Oil prices are higher again, and so too are iron ore prices…With BHP warning of a near-term, correction (downwards) and with output of iron ore soaring, the rally should be treated with a bit of caution, but it’s going to go on supporting the Australian dollar for now.

The oil price rally by contrast has better foundations as the supply/demand imbalance is slowly being resolved and while the upside is limited, confidence that the cycle has turned is growing and that will remain a big FX driver.

We’re long AUD/NZD* and the iron ore bounce should help, and short USD/CAD, EUR/RUB and GBP/NOK, all trades which get help from rising oil prices.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.