Tension is much higher after the recent reports that the BOJ could be willing to pay banks for them to lend. What’s in store for the April 28th meeting? Here is a preview from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

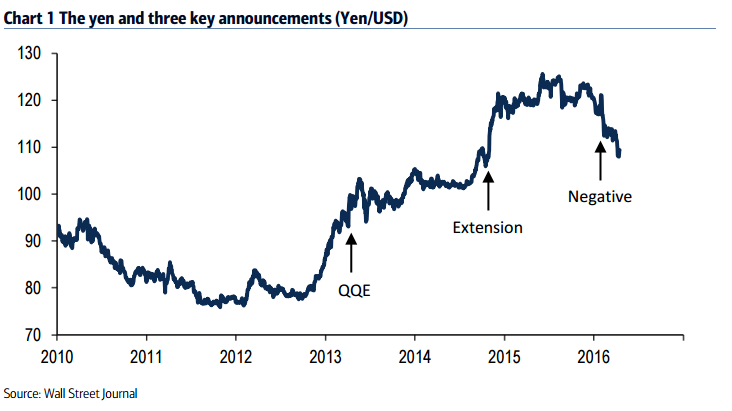

The BoJ is scheduled to hold its Monetary Policy Meeting on 27-28 April. After a promising start, Abenomics has clearly lost momentum. How does it get it back? For the BoJ, the next step is critical. The January experience suggests a small move in an adverse market is a mistake. As with the first two big announcements, they need to try to build on market momentum and take a decisive step. If they are going to move interest rates deeper into negative territory it should be paired with an aggressive expansion of QQE.

Specifically, we expect the BoJ expand its QQE policy at the April or June meeting with the former slightly more likely. In our base case the main stimulus is a doubling of annual ETF purchases from ¥3tn to ¥6tn. Other moves are possible including a small further move into negative rates, but we think that should not be the main policy change given the risk of another adverse market response. We also see a significant chance that the BoJ waits until June for its next move, but June seems like a bit too long to wait and in April they need to announce new forecasts that could complement the policy change.The demographic and debt clocks are ticking. A return to a more decisive BoJ is only a small part of what is needed. Easy monetary policy can jump start growth and inflation, but the rest of Abenomics must do the heavy lifting thereafter. First and foremost, they need to get moving on raising potential GDP growth through structural reform. Second, and almost as important, the government needs to get the sequencing right on fiscal policy

In our view, they should delay the consumption tax hike until there is clear evidence deflation has been defeated. Even by threatening to hike rates the government is probably helping push up the saving rate. More important, this policy has always amounted to putting the cart before the horse. The hike should be a secondary part of a broader tax reform, not the centerpiece of the reform. A highly visible contractionary tax increase combined with a subtle partly offsetting fiscal stimulus hurts aggregate demand.

USD/JPY to rise on higher equity price, but we would sell on strength

USD/JPY is expected to keep recovering temporarily above 110 on correlation with Japan equities, but the impact is unlikely to be sustainable. BoJ ETF purchases will directly impact supply and demand on the stock markets, but its long-term impact on the real economy and risk sentiment remains unclear while the BoJ buying Japanese shares is unlikely to crowd Japanese money out of domestic markets. Rather, BoJ purchases are likely to crowd foreign money into the Japanese market–though of course much of this may be FX-hedged.

Two-week risk reversal in the currency markets has corrected drastically ahead of next week’s BoJ meeting as the market’s expectation for BoJ’s action has risen to all time-high but one-month risk reversal has not reacted as much.

This reflects (1) growing expectations of BoJ’s action; (2) expectation for decent short-term impacts from potential easing due to lower USD/JPY level and JPY long positions; and (3) expectation for limited medium-term impacts on the other hand. This is largely consistent with our own views.

As the BoJ is expected to implement qualitative easing, selling USD/JPY on rallies seems to be a sound FX strategy, in our view.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.