The Federal Reserve is expected to leave policy unchanged in April but this doesn’t mean no market moves. Can the Fed lift the dollar?

Here is their view, courtesy of eFXnews:

Our economist remains of the view that the next policy move is most likely to occur at the June meeting.

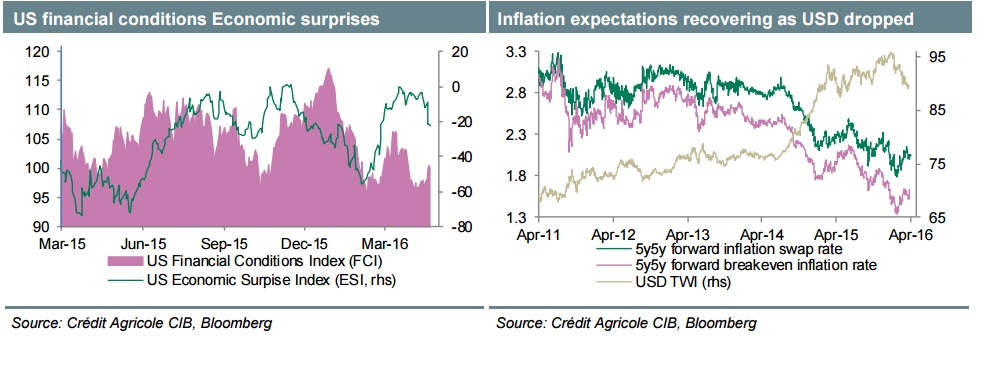

Financial conditions have fully recovered (our FCI eased since March) and market inflation expectations have moved off their lows. Two obstacles remain, however. Incoming US data now points to a Q1 growth slowdown while the global growth picture remains in a precarious state. Nevertheless, the Fed is likely to downplay the Q1 growth slowdown. With the Fed’s emphasis on data dependence, the policy statement may be hesitant to offer any clues on near-term policy firming but at the same time it is unlikely to exceed dovish expectations.

Any hawkish surprises could come from certain tweaks to the statement, eg, downplaying sluggish Q1 growth and/or a revised assessment of the balance of risks and global developments.

In summary, more constructive tweaks to the statement’s tone would be consistent with the Fed’s call for continued rate normalisation this year and a further delay would be another blow to the committee’s credibility.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.