The British pound is showing extraordinary resilience and continues marching forward despite Brexit fears. This could extend:

As oil prices recovered and equity prices rose, the GBP appreciated as expected. Thus the thesis that global factors predominate has been justified so far. Note that during the same period the Brexit chance has not diminished – on the contrary, the “leave” camp, as judged from polls (FT poll tracker), has edged higher over the past few months.

Here is their view, courtesy of eFXnews:

UK current account gap – a worry?

The large current account deficit has been cited as one of the main risks in connection with a UK exit. Indeed, the latest reported figures showed the current account gap rising to above 5%/GDP. Big. But is that a big deal?

True, it makes the UK dependent on foreign flows. Yet one may flip the argument around: it also means that there is enough foreign willingness to finance it. These are two sides of the same coin in the balance of payments – as long as foreigners are willing to invest in the UK, there is enough money to finance the purchase of foreign goods, and vice versa. So if anything, the latest rise in the current account deficit is just a sign that foreign financing has been increasing. In fact, the willingness of foreigners to finance the UK deficit as judged by portfolio and FDI inflows has been the highest in decades lately!

In any case, the large current account gap will remain the reason for the market to fear Brexit, and thus make the GBP weakest among the G4 currencies, most subject to risk-off. Net trade was the biggest drag on GBP lately, too (-0.9pp of GDP in Q4 2015) – thus a concern for the Bank of England (BoE). But looking at the short term, the GBP weakening of close to 10% we have seen since last autumn should support exports in the near term, thus the trade balance flow will be less GBP negative.

Wage growth to support BoE hike

The market is still very dovish regarding the BoE. Not as extremely dovish as last month, but still: the first hike is seen in more than 30 months, with more than 10% chance of a 25bp cut this year. This contrasts with our base call that we will see the first hike happening within a year, not in three years as the market pricing suggests. Are we right?

Yes, if you look at domestic data. While the industrial data have slowed lately, the housing market performance is still solid. More importantly, wage growth is edging higher. Judging from the leading indicators, wage growth should pick up, thus forcing the market to reprice the BoE towards a rate hike sooner. Finally, inflation is rising again and inflation expectations are well anchored. The GBP weakness is already contributing to higher inflation and should push headline inflation higher in the months ahead.

Searching for fair value

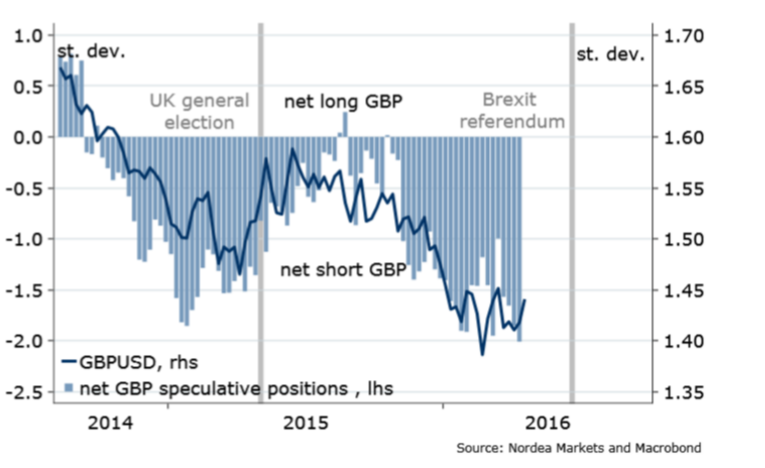

So, has the GBP weakened enough? It is notable that the GBP speculative positioning is still record net short. But we may be getting to the beginning of the end of increasing the net shorts. After all, being exposed to the binary event is not to everyone’s liking. Looking at the options market, the GBP also stands out as extreme, for example the 1Y GBP/USD 25D risk reversal stands close to -4, a historical low and out of sync with the rest of the market. Too low to hold.

The valuation is GBP supportive ahead of the 23 June Brexit referendum. The short-term fair value models point to levels of EUR/GBP below 0.77. Even our long-term PPP model suggests that EUR/GBP is undervalued (fair value at around 0.72). Thus in the short term the GBP should strengthen in that direction. We stick to our call – GBP/USD is on the way to 1.46-1.48 in the coming few months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.