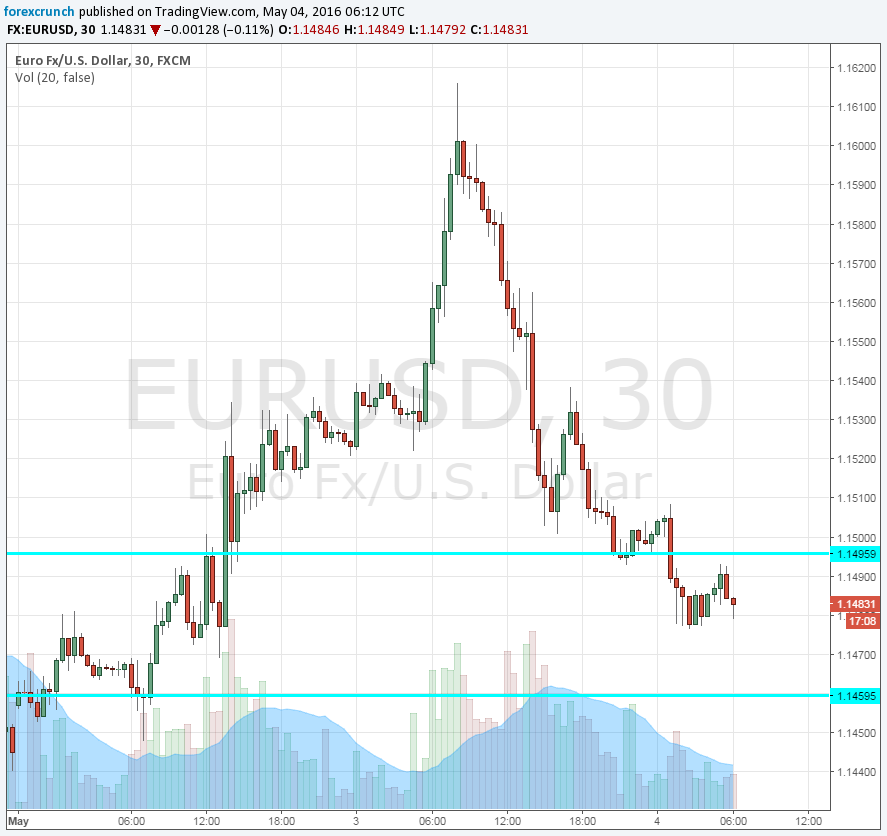

EUR/USD is consolidating its position outside the safe haven camp and made a full turnaround. Does it have more room to the downside?

Here is their view, courtesy of eFXnews:

From the perspective of the dollar going forward, we do not see any compelling reason for altering our EUR/USD forecasts dramatically. Some data like the ISM and jobs data point to some recovery in economic activity going forward and certainly if you assume broader financial market conditions were at least in part to blame for the slowdown, then the dramatic improvement in financial market conditions also point to a brighter outlook ahead. The fall in corporate profits in Q3 and Q4 (and possibly in Q1 as well) taking us into an ‘earnings recession’ remains a concern however and we believe the FOMC will therefore thread very carefully with proceeding with additional rate increases.

Our call has been for a June and December rate increase and we have to acknowledge that the chances of a June rate increase are coming down. The failure of the FOMC to provide a risk assessment in its April statement was telling. However, assuming economic activity does pick up, the next rate increase will probably only be delayed until July or September. The pick-up in the core PCE inflation rate to 2.1% in Q4, underlines the need for action as conditions improve. So May will be a crucial month for the US economy and we are anticipating the emergence of evidence pointing to better economic conditions.

We still expect the next sustained EUR/USD move to be to the downside and hence any break higher should prove short-lived. Our end-Q4 2016 forecast is 1.0900.

BTMU targets EUR/USD at 1.14, 1.11, and 1.09 by the end of Q2, Q3, and Q4 respectively.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.