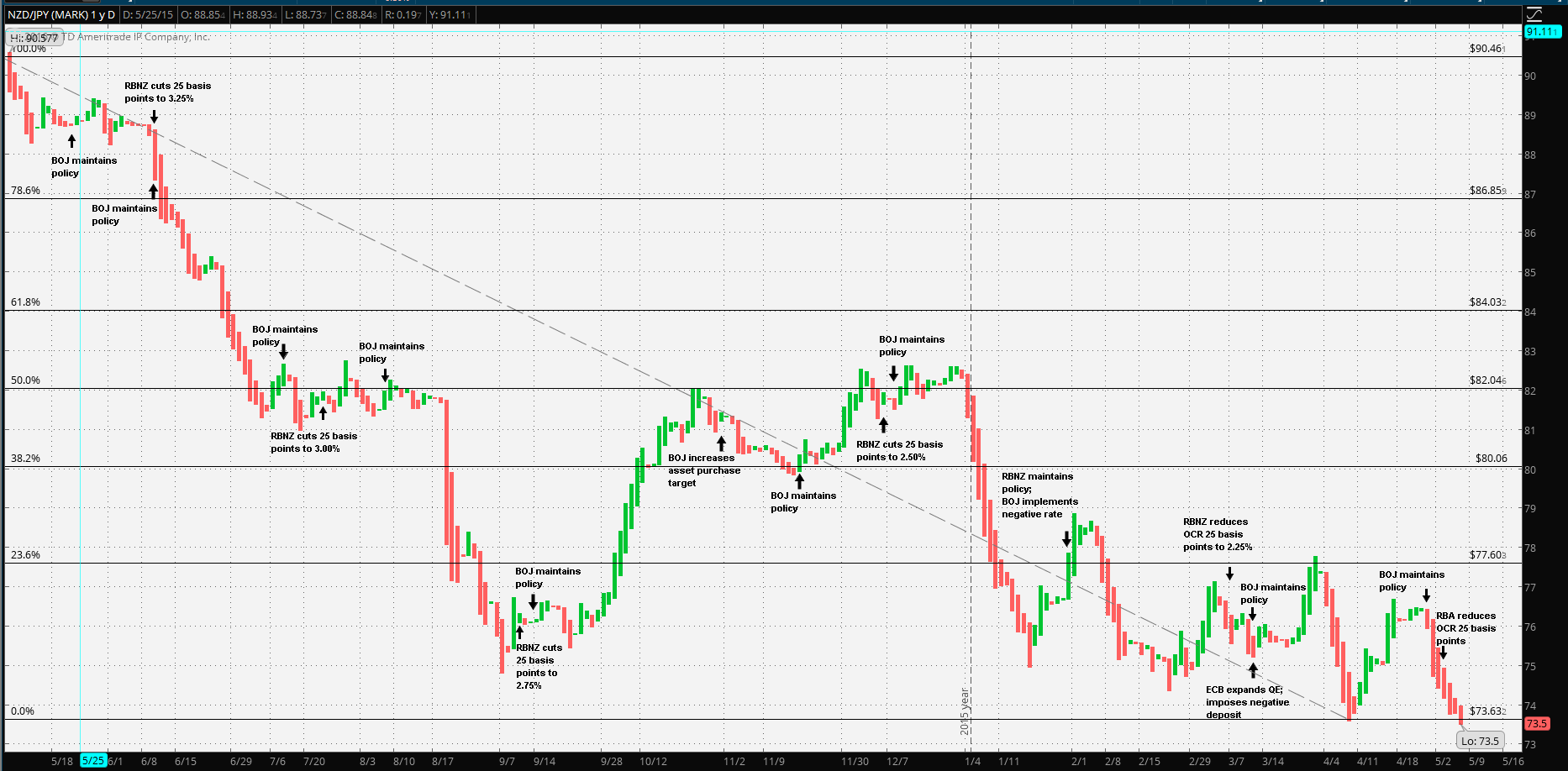

On 29 January, the Bank of Japan took a significant step in its vigorous efforts to stimulate growth in the Japanese economy. “…The Bank will apply a negative interest rate of minus 0.1 percent to current accounts that financial institutions hold at the Bank. It will cut the interest rate further into negative territory if judged as necessary…” If the sudden change in policy direction wasn’t enough of a surprise, the Yen still continued to strengthen against all majors after a weakening a bit on reaction to the news. On 12 February the Nikkei unraveled, closing lower by 4.8% as the Yen powered on. The Nikkei reversed after the weekend regaining losses and closing 15 February 7.2% higher. Once again the Yen was the driving factor having weakened after a poor Japanese GDP report.

The Reserve Bank of New Zealand may be watching the Yen power higher against the Kiwi with a fair dose of amazement and an even greater dose of relief. New Zealand’s export economy has been an accidental victim of global accommodative monetary policy actions, particularly when it comes to agricultural exports. Japan accounts for a significant 6.2% of New Zealand’s export market. That’s well behind China at 20%, Australia at 16% and the USA at 8.9%, but clearly an important trade destinations at 4th highest. Dairy, bovine meat and fish account for 22.39% of total exports to Japan. Other fruit and vegetable exports account for another 10% and importantly raw aluminium exports to Japan account for 15%. Hence a much stronger Yen makes these consumer staples imports far less expense on Japan’s retail store shelves.

Guest post by Mike Scrive of Accendo Markets

It’s obvious that having a favorable currency exchange is advantageous for any export economy. It particularly benefits New Zealand as it suddenly finds itself competing against the now unrestricted EU dairy industry plus an ECB driven Euro. Over the past year, the Yen has gained 12.844% vs the Euro, 14.883% on the USD but 18.706% versus the Kiwi. The RBNZ has aggressively reduced its overnight deposit rate 100 basis points over the past 12 months. Clearly, the RBNZ created an advantage for its much smaller agriculture driven export economy so it’s likely not overly concerned about continued Yen strengthening.

The question is whether it is to the advantage of the RBNZ to take further action in the form of another 25 basis point OCR reduction to 2.00%, or allow the Yen to continue with its rally until the BOJ draws the line. A further rate reduction would potentially weaken the Kiwi further vs the Euro, USD and other dairy market competitors thus benefitting an important NZ economic sector. It’s important to observe that New Zealand’s agricultural exports to Japan, as well as other trading partners, are consumer staples, thus non-cyclical. It’s a different story for industrial commodities like aluminum or petroleum. There’s no shortage of competition against New Zealand’s raw aluminum exports. Excluding New Zealand, the largest raw aluminum exporters account for nearly ¾ of global raw aluminum production; a weaker Kiwi may not contribute all that much towards New Zealand’s raw aluminum exports.

As the bank noted in the March statement, “…In the dairy sector in particular, a more-extended period of low prices would add to pressure already on farm balance sheets. Lower world inflation could also lead foreign central banks to ease policy further…” In other words the efforts to counter disinflationary trends in larger advanced economies could offset the current Kiwi exchange advantage.

The RBNZ also took note of Japan’s policy action, observing that “…The Bank of Japan surprised markets in late January, by announcing a move to negative interest rates on some excess reserves… …Since then, further strengthening of the yen has increased market expectations of easing this year through one, or a combination of, more-negative interest rates and increased asset purchases… …These trends in global monetary policy are important for New Zealand… …particularly for the New Zealand dollar exchange rate… …If markets change their expectations… …this could limit depreciation of the New Zealand dollar…”

Although the underlying reasons for the seemingly unstoppable Yen rally might be unclear, eventually it will reach a tipping point for BOJ Governor Mr. Haruhiko Kuroda. What final straw might tip the scale for Governor Kuroda is uncertain; however, former Japanese vice Minister of Finance Mr. Eisuke Sakakibara commented in an 11 April Bloomberg interview that ¥105 to the USD would be “no problem” and further expected the currency to reach ¥100 by year’s end. Amazingly, his prediction has been accurate so far with the Yen trending higher to ¥106.309 per USD, a 1 year high, on 2 May.

The logic might compel patience. The whole point is that the RBNZ currently carries an advantage over its larger competitors in its regional, major export markets. If the BOJ takes an unexpected action between ¥105 and ¥100 to the dollar, the RBNZ can react with a further 25 basis point reduction after the fact. If the RBNZ moves ahead of the BOJ, global reaction to a BOJ action might offset the preemptive move.

On 4 May, the PBOC decreased the Yuan-USD fixing rate. The Kiwi remained within its USD $0.6852 support to USD $0.7005 resistance range; i.e., not much of a reaction.

It seems that the logical course of action would be to let the Yen rally run and wait for the BOJ take any action first. In the meantime, work within the status quo.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”