The US dollar enjoyed a few positive figures and the tables have turned in its favor. Is there more room to the upside?

Here is their view, courtesy of eFXnews:

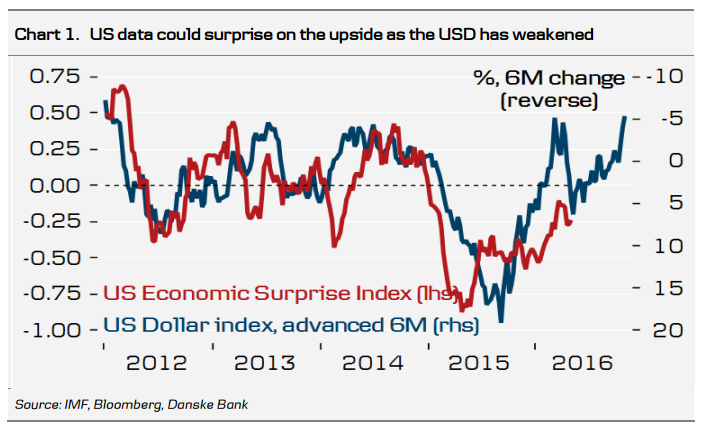

The Fed’s Rosengren said last night that the market is ‘too pessimistic’ about the US economy and the likelihood of the central bank removing accommodation is higher than currently priced in. We agree. To us, it appears that a significant part of the negative growth surprises in the US in recent quarters can be explained by lagged effects from the strong USD filtering through to the IP/export cycle. (See Chart 1). As the USD has weakened, this could support the US economy in coming quarters. The collapse in the USD on Tuesday 3 May and the sharp reversal marked the end of the USD down-trend, in our view.

Typically, sharp reversals from extended moves mark the end of a trend and we think that was the case this time. Interestingly, the USD reversal has come at the same time as US data has been soft, US rates have headed lower and risk appetite is fading. While the market in late 2014 and early 2015 bought the USD as an asset currency, those dynamics are gradually changing as global growth is converging. From the market being extreme USD bulls at end-2015, it has shifted to become very USD bearish, with major newswires flagging the USD downtrend and IMM positioning showing that the market is now short the USD for the first time since May 2014. We believe that the USD has bottomed – for now – particularly versus European currencies where Brexit risks will weigh on sentiment.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.