The Australian dollar has seen better days and here are two opinion saying it could fall even more, and not only against the greenback.

An assault on the lows?

Here is their view, courtesy of eFXnews:

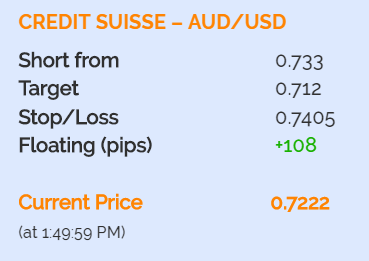

AUD/USD: Staying Short Targeting Late Feb Lows – Credit Suisse

AUD/USD continues to consolidate but, whilst still capped beneath .7311, the immediate risk can stay lower for a retest of the recent low at .7176 initially, then the late February lows at .7109, notes Credit Suisse.

“We would expect fresh buying to emerge for a bounce here, but a direct break lower can suggest more weakness for .7069/64, then .6973,” CS projects.

Resistance stays at .7299/311 initially, followed by .7334 and then .7368/69. A direct break higher can see a test of .7403 which ideally caps to maintain the downside bias,” CS adds.

In line with this view, CS maintains a short AUD/USD from 0.7330 targeting a move to 0.7120.

AUD 2nd Most Expensive Currency In The World; Sell AUD Vs G3, sell AUD/NZD – Deutsche Bank

Bond inflows to Australia are likely to fall off a cliff even before the RBA cuts rates toward 1%. A possible Labor win in July could dampen house price inflation. Externally, commodity prices and global risk should deteriorate as China slows.

Admittedly, AUD has lost many supporters lately, but positioning remains net long on IMM and neutral on Corax. Valuation is supportive, too, with AUD the most overvalued currency after HKD (chart 6). Since valuation has lately become a dominant driver of currency performance, this is likely to weigh on the lifestyle. Overall, therefore, we think entry levels are still attractive. The market has failed to fully price the magnitude of the currency adjustment Australia needs.

We like selling the Aussie against G3 equally weighted to avoid undue exposure to an uncertain dollar/Fed outlook on the one hand and the TWI’s exposure to a peaky Asian EM complex on the other. We also like this narrow basket because, compared to AUD/USD, it has greater positive betas to Australia’s idiosyncratic terms of trade and rates, as well as to global risk sentiment. The grass is greener on the other side

We also see relative value in selling AUD/NZD. While kiwi valuation and positioning are similar to the Aussie, we expect macro trends to divergence over the next months. For one, the RBNZ is more on top of the curve since the March cut, and the inflation pulse could improve notably in the second half of the year. Regardless of RBA easing, therefore, we don’t expect the OCR to fall below 2% this year, and the likely cut to 2% in June is already half discounted by the market. Moreover, while New Zealand’s terms of trade should also suffer from slowing Chinese credit growth and a stronger dollar, the dairy sector now looks fundamentally stronger than iron ore in particular. European producers are rapidly exiting the market as their feed costs soar along with global grain prices.

As monetary policy and the terms of trade move in the kiwi’s favour, parity could soon come into sight again.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.