The Canadian economy is not enjoying the weak Canadian dollar and with reduced oil production, the higher prices of the black gold are not really helpful. But these are not the only reasons for a cautious. There are two more according to the team at Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

We expect the Bank of Canada (BoC) to hold the overnight rate at 0.50%, but strike a cautious, dovish tone in their policy statement. The focus will be on the statement itself, since there is no press conference, and an on-hold stance is largely expected.

We see a cautious tone for a few key reasons.

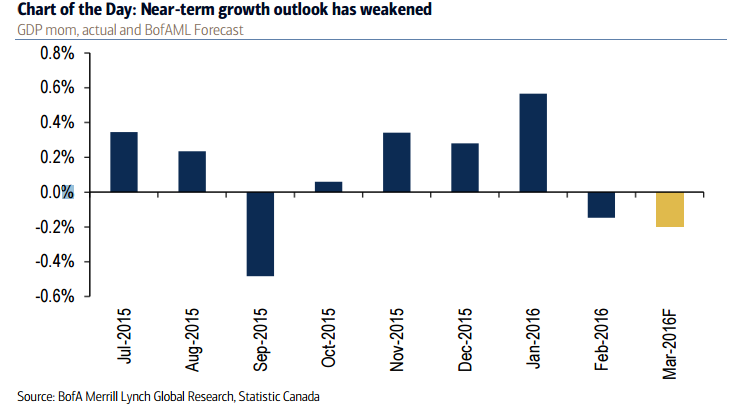

First, recent economic data have been weak, and we now expect GDP to decline slightly in March, the second straight monthly drop. (Chart of the Day). As a result, we have downgraded 1Q GDP to 2.8% from 3.5%. We also have cut 2Q GDP growth to 0.2% annualized, reflecting a weaker handoff in March. This has pushed 2016 average GDP growth to 1.6% from 1.8%.

Second, the latest Statistics Canada Capital and Repair Expenditures Survey revealed a surprisingly weak forecast for factory capex in 2016: down 11% YoY. This is the weakest reading since the recession. Furthermore, the result is negative for manufacturing production, as factory capex is closely correlated with factory production. This is bad news for the BoC, which has pinned its hopes on a factory sector recovery.

FX: BoC caution to support continued USD/CAD uptrend

The most critical driver of the FX reaction will be the statement’s tone. A cautious statement, as we expect, will challenge the slight upward slope to the OIS curve. With the FX market showing a renewed focus on the policy divergence theme as the Fed has communicated openness to summer hikes (against market expectations) in the past week, this dovish tilt is likely to push USD/CAD up further from a rate differential perspective, which currently looks fair. But the extent of the move could be limited by price action in the CAD and oil. Despite the over 10% rise in oil since their April meeting, USD/CAD is about 3% higher. This is likely a welcome development for a BoC who pushed against CAD strength in their April statement, noting CAD strength posed risks to non-energy exports. The CAD has weakened recently, but is still stronger than earlier in the year so the risk is the FX language stays, particularly against the backdrop of the weak trade balance discussed above. Bottom line, we expect the BoC to support, but not necessarily accelerate, the move higher in USD/CAD we have seen in recent weeks. The next leg higher is more likely to come from the Fed side than from the BoC.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.