The team at Goldman Sachs remain dollar bulls and release upbeat targets for the greenback against its major peers.

Here is their view, courtesy of eFXnews:

Our big picture views are well known. We are Dollar bulls, since we think the 300 bps tightening cycle our US economists forecast (through 2019) maps into a 15 percent rise in the greenback. We are very bearish the Yen, since we believe there is only one way forward for the BoJ in its pursuit of reflation: to continue surprising markets on the dovish side.

We think $/JPY upside is actionable near-term, with 3-, 6- and 12-month forecasts of 115, 120 and 125, respectively.

We remain Euro bears and have kept our forecast for the trough in EUR/$ unchanged at 0.90 on a three-year horizon. However, recent ECB meetings have disappointed us and we have scaled back our expectation for EUR/$ downside near-term, lifting our 12-month forecast from 0.95 to 1.05.

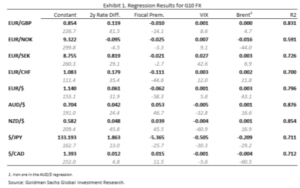

We updates our regression models for each of the G10 crosses we forecast. These models map things like interest rate differentials, commodity prices and global risk appetite into FX and are one input into our forecasts.

In some cases, this exercise gives strong signals:

(i) it puts the Brexit risk premium for EUR/GBP around 5-8 big figures, so that EUR/GBP could move sharply lower in the event of a“remain”vote;

(ii) it suggests that $/JPY is now too low relative to nominal rate differentials, a striking result given that nominal differentials have failed to keep pace with QQE and supportive of our call that $/JPY upside is substantial;

and (iii) the recovery in commodity prices since January is supportive of AUD/$, a signal we take note of, but at this point are inclined to fade.

![]()

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.