It’s an election year in the US and the contest is wide open. Will the Fed take an election holiday? No, says the team at Bank of America Merrill Lynch.

Here is their view, courtesy of eFXnews:

Over recent weeks a number of clients have asked: “will the Fed be deterred from raising rates due to a presidential election?” Recent Federal Reserve commentary, history and central bank independence all indicate that the answer is “no.”

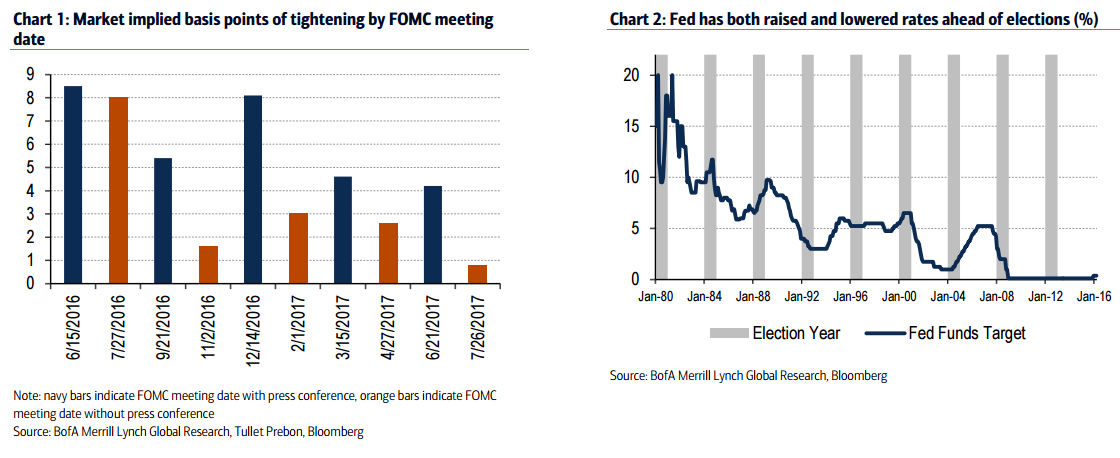

Assuming that the Fed felt sufficient progress had been made to warrant another rate increase, the Fed would only likely delay if this November’s election coincided with heightened economic uncertainty that weighed on the outlook or resulted in a material tightening of financial conditions. Market pricing currently assigns the largest incremental probabilities to the next rate move in June or July, with more limited pricing for September and November FOMC meetings, as shown in Chart 1.

The Fed will likely treat meetings ahead of the election as “live” and we recommend that investors view them similarly. We believe the timing of the next rate increase is most likely in September, although a summer rate hike remains a possibility — particularly in light of recent Fed communications.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.