It’s a very busy week for markets with a buildup to the NFP, OPEC meetings and lots more. The team at CIBC look at the situation in North America:

Here is their view, courtesy of eFXnews:

CAD: Rate Spreads Taking Over From Oil.

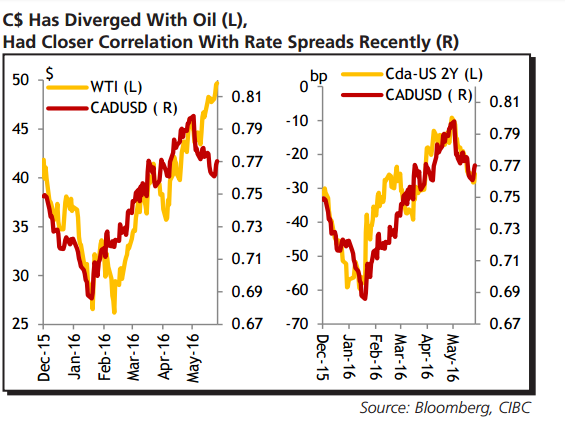

No economic news was good news for the Canadian dollar this week, particularly with oil prices rebounding further and the BoC coming out with a very balanced statement. However, with the data continuing to point to a softening Q2 in Canada and the US economy turning around sharply, there’s scope for interest rate spreads to move in favour of the US.

And for the past couple of weeks, it’s been interest rate spreads more than oil that’s been driving the C$. We expect the loonie to depreciate further against a revitalized greenback, with USDCAD heading back into the mid-1.30s.

USD: Payroll Ambiguity a Roadblock to a June Fed Hike

We’re bullish on the US$, with markets still pricing in too little from the Fed. However, we also think the greenback will appreciate gradually rather than be given a shot in the arm from an unexpected June rate hike.

Even with more hawkish comments recently, it would probably take an unambiguously strong employment report next week to see the Fed move at its next meeting. The problem is that there’s often a lot of ambiguity.

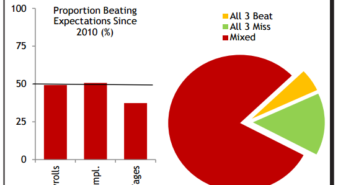

Indeed the three major indicators we look at (payrolls, unemployment and wages) have simultaneously beaten expectations only four times since 2010. That’s around 5% of the time—a pretty low probability that keeps us leaning towards a September hike.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.