German Preliminary GDP is a measurement of the production and growth of the economy and is considered one the most important economic indicators. A reading which is better than the market forecast is bullish for the euro. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 6:00 GMT. Indicator Background German … “EUR/USD: Trading the German Preliminary GDP”

Month: May 2016

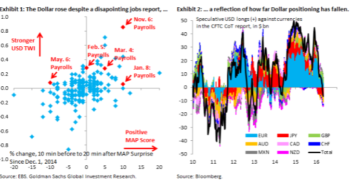

The USD Has Bottomed; Stay Long USD/JPY – Goldman Sachs

The US dollar had an impressive “Turnaround Tuesday” and managed to beat its rivals. The team at Goldman Sachs sees more gains ahead, and eyes one specific pair. Here is their view, courtesy of eFXnews: Last week’s disappointment on payrolls offers an important insight on positioning. As Exhibit 1 shows, even though the data were a … “The USD Has Bottomed; Stay Long USD/JPY – Goldman Sachs”

Greenback Pulls Back on Profit Taking, Fed

US dollar is giving back some of its recent gains today, heading lower as Forex traders step up their profit taking, and as speculation that the Federal Reserve will stay away from further rate hikes the rest of the year increases. Greenback had seen some gains earlier this week, but now it is lower against its major counterparts. US dollar has largely given … “Greenback Pulls Back on Profit Taking, Fed”

UK Production Misses Expectations, Sterling Suffers

The Great Britain pound was soft today as Britain’s manufacturing and industrial production failed to meet analysts’ expectations. While production rose in March after falling in February, its growth trailed forecasts. Manufacturing rose by just 0.1% instead of the predicted 0.4%. Industrial production grew 0.3% compared to the consensus forecast of 0.7%. GBP/USD was little changed at 1.4434 as of 13:31 GMT today after falling from the opening of 1.4440 to 1.4394 intraday. … “UK Production Misses Expectations, Sterling Suffers”

Australian Dollar Mixed After Economic Data

The Australian dollar gained on its US counterpart but fell against the Japanese yen after the release of mixed economic data from Australia. The Westpac Melbourne Institute Index of Consumer Sentiment jumped by 8.5% in May after falling 4% in the previous month. The number of home loans fell by 0.9% in March from February, but the drop was smaller than analysts had forecast (1.4%). The Australian dollar was moving erratically today, … “Australian Dollar Mixed After Economic Data”

FX Traders, Now’s ‘Not The Time To Give Up Currency

Foreign exchange trading sees fluctuations according to volatility and other market conditions. The team at Duetsche Bank has encouraging words for traders: Here is their view, courtesy of eFXnews: The international press is replete with stories of poor investor returns and discretionary fund closures this year. Reuters reports1 that Q1 2016 marked the first quarter of outflows … “FX Traders, Now’s ‘Not The Time To Give Up Currency”

Swiss Franc Drops as Unemployment Rate Rises

The Swiss franc fell against the US dollar and the euro today. One of the possible reason for the drop was the increase of the unemployment rate. The Swiss unemployment rate rose from 3.4% to 3.5% in April according to the State Secretariat for Economic Affairs. The news fueled speculations that the Swiss National Bank will continue attempts to weaken the franc. Yesterday, the Swiss Federal Statistical Office reported that monthly consumer inflation remained at 0.3% last month, … “Swiss Franc Drops as Unemployment Rate Rises”

Australian Dollar Rises on China’s Data

The Australian rose today with the help of relatively decent economic reports from China. China’s consumer annual inflation remained at 2.3% in April, unchanged from the previous month and in line with expectations. The Producer Price Index continued to fall but with slower pace, dropping 3.4% last month (year-on-year) after declining 4.3% the month before. The reports gave hope that the economy of the Australia’s biggest trading partner is stabilizing. … “Australian Dollar Rises on China’s Data”

USD/CAD: Trading the US Crude Oil Inventories

US Crude Oil Inventories measures the change in the number of barrels held in inventory. The report is published each week. A reading which is higher than the market forecast is bullish for USD/CAD. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 14:30 GMT. Indicator Background As Canada is … “USD/CAD: Trading the US Crude Oil Inventories”

Sterling Sees Advantage in Currency Trading

UK pound is seeing an advantage today, heading higher against its major counterparts. For the most part, however, gains by the sterling are more about other currencies’ weaknesses than the pound’s strength. There is still plenty of uncertainty to go around with regard to the UK pound. Sterling is higher against other major currencies, eking out gains after a rough few days. The UK pound is seeing … “Sterling Sees Advantage in Currency Trading”