The EU Referendum in the UK also has an impact on the main currency of the EU, the euro. The common currency could suffer or enjoy the impact. The team at Citi analyzes the potential move.

Here is their view, courtesy of eFXnews:

Whatever the outcome of the referendum, trading should expect contagion (both good and bad) is not limited to the UK. The macro outlook for Europe and 2017 political risks in Germany, France and the Netherlands are all tied to the UK’s decision. The most immediate wind-test for Europe should be the Spanish elections set for Sunday June 26th (which by themselves create EUR risk as well).

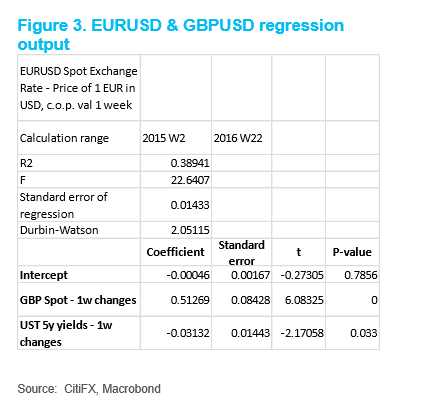

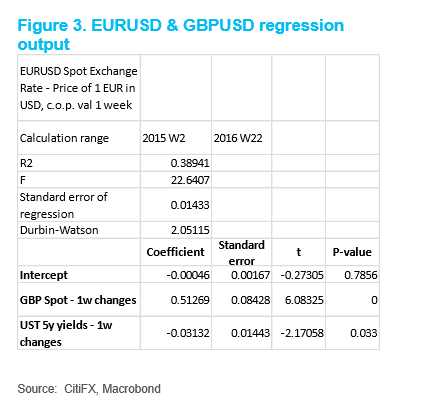

To gauge sensitivities for EURUSD, we run a simple least squares regression of 1-week changes in EURUSD on 1-week changes in GBPUSD and 5-year US treasuries. We are making assumptions that GBPUSD picks up the brunt of the referendum risk with US treasuries capturing both Fed and changes to the US outlook that could drive EURUSD either higher or lower. The output from this is below, and for such a simple test it does a pretty good job explaining changes in EUR.

Elasticity of EURUSD to GBPUSD is roughly 50%, after taking out the Fed & US impact.

This implies for the risk surrounding the UK referendum, a 5-6% rally of GBPUSD on a REMAIN vote could raise EURUSD by 2.5-3%. A 10-12% move of GBPUSD on a LEAVE vote would translate into a 5-6% move lower in EURUSD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.