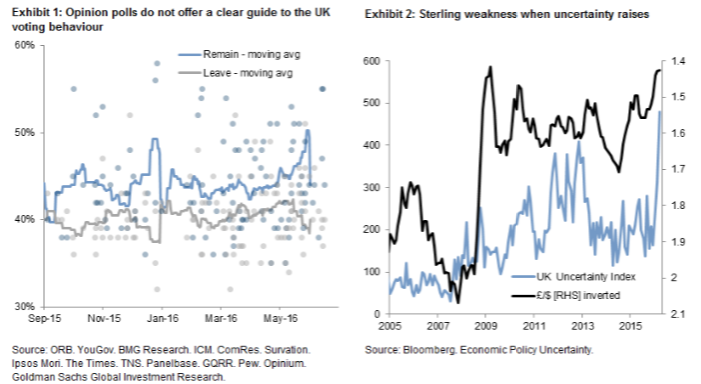

The EU referendum is just around the corner and opinion polls are already moving the pound on a daily basis, overshadowing economic indicators. What is the trade? Not necessarily GBP/USD – there are other crosses as well:

Here is their view, courtesy of eFXnews:

As was the case for all major currencies, Sterling went up in response to the very weak US Jobs report on Friday (June 3), but in relative terms it underperformed. The GBP depreciated vis-a-vis the G-10 currencies (with the exception of the USD), a trend that picked up again about ten days ago, when polls on the upcoming referendum on the UK’s membership of the European Union suggested again that the outcome would be a close call.

As we approach the referendum date, positioning around the event remains an important macro theme, and in this FX Views we provide an update on our thinking on Sterling.

After the referendum, if voters decide that the UK should continue to be a member of the European Union, EUR/GBP could move sharply towards our 12-month forecast of 0.70. If there is a vote to leave the EU, we estimate that Sterling could weaken by about 10% in trade-weighted terms due to the uncertainty that such an outcome would create. According to our estimates, EUR/USD could fall by about 4%.

Tactically, over the next couple of weeks (until June 23), we think risk-reward is for downside in Sterling, which in trade-weighted terms is still about 2% above its lows at the end of February.

We prefer GBP/USD downside to EUR/GBP upside. GBP/CHF and EUR/CHF downside are two other risk-off trades that we would expect to perform well in the event of a ‘Leave’ vote. By contrast, we do not like GBP/JPY downside.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.