The pound certainly suffered amid growing fears of Brexit and a worsening global situation. In or out, the team at SocGen sees further falls:

Here is their view, courtesy of eFXnews:

Less than two weeks before the referendum on UK membership of the EU leaves us even more hostage to fortune than usual, but we expect to see sterling lower by the end of 2016, regardless of the outcome. The UK economy was losing momentum before the referendum was announced and is still doing so. We do not expect the MPC to be able to raise interest rates in the current cycle at all – a long period of neutral policy seems assured. That’s good for gilts, not so much for the pound.

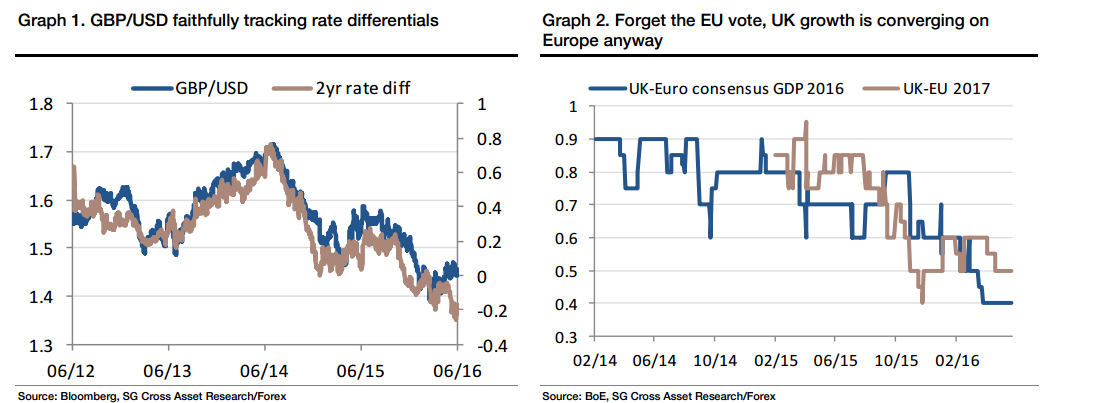

Our end-year forecast for the EUR/USD (lower) is all that keeps the EUR/GBP forecast marginally softer and pushes sterling weakness into the GBP/USD. This pair has tracked relative interest rates more closely than any other G10 currency pair in recent years and, if anything, has lagged the move in rates during the last couple of months as sterling has benefited from a short-covering rally in the run-up to the EU vote. If we simply extrapolate the correlation of the last few years in the GBP/USD, based on SG forecasts for 2-year interest rate differentials (widening from 17bp currently to over 50bp by year-end and 90bp in mid- 2016), the GBP/USD could be below 1.35 by year-end and closer to 1.25 by mid-2017. Those numbers are well below our forecasts, but do encourage us in our belief there is more sterling weakness to come, even if we do see a post-referendum bounce first.

Our core strategy will be to sell GBP against the EUR and USD on any post-referendum bounce, assuming we see a ‘remain’ outcome that takes the EUR/USD and GBP/USD higher.

On an exit, both the GBP/USD and EUR/USD are likely to fall, and keep on falling. On a UK ‘Exit’ we are likely to see GBP/USD test 1.25 this year, and indeed, the EUR/USD could fall sharply too (to 1.05?). That would take EUR/GBP towards 0.85.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.