Since March, the European Central Bank (ECB) has held interest rates at 0% in hopes of strengthening Europe’s economy. Some felt that this was a move of desperation for the central bank and many expected the rates to rise in the months following.

Economists, however, were not surprised when the bank’s policy did not change. Instead of changing rates, ECB has begun buying corporate bonds and cutting the interest rates. This is in support of its quantitative easing program designed to put money back into the economy.

By easyMarkets

Inflation Targets

The central bank’s Chief, Mario Draghi, has called on governments to assist the ECB in fulfilling its inflation target of just under 2%. Last month, the rate was sitting at -0.1%, well below its goal. Draghi suggests that changes in government policies on items such as employment and trade barriers would be conducive to economic growth. Without government cooperation, Draghi believes that the bank itself can only do so much for the economy.

Deutsche Chief Economist, David Folkerts-Landau, reportedly accused the ECB of attempting to delay necessary structural reform. Its quantitative easing program, according to Folkerts-Landau, has damaged savers’ financial standing and is damaging the entire European project. The policy has shown to reward financial irresponsibility, whether that be domestic or corporate in nature.

New Programs

ECB will implement a program on June 22nd in which it will pay commercial banks to use its money. The banks will be required to lend the money to its customers. This plan is an attempt to remedy the credit shortage in certain areas of Europe, namely Italy.

As the ECB quickly learns that its quantitative easing program and lack of policy change are not bolstering the economy as expected, the central bank will likely reevaluate its course of action. Chief Draghi will continue to seek government guidance on economic actions in the coming months.

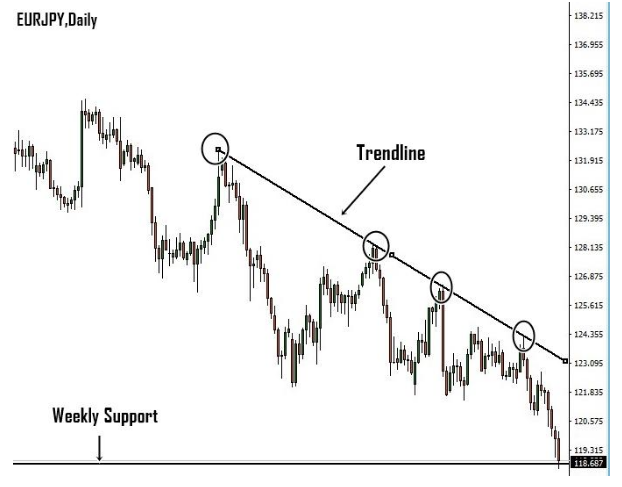

EUR/JPY technical outlook (14 June 2016)

Key Resistance: 132.00

Trendline Resistance: 123.10

Minor Support: 118.60

Major Support: 111.60

Trading Stance: Wait for rallies and look for a potential sell setup near the daily downtrend line with price action confirmation.

Figure: EURJPY technical analysis, daily

The daily downtrend in the EUR/JPY pair is showing nice downward momentum by making successive lower highs associated with lower lows. Price is too close to the weekly support level which argues against going short. We will wait for a minor retracement of the pair to trendline resistance at 123.10, and enter short with a valid price action confirmation signal.

The initial bearish target of the pair would be the minor support level 118.60. A clear break of the minor support level will confirm further downward movements toward the next major support level at 111.60 On the contrary, if the pair breaks the bearish trend line we can assume that a short-term bottom is in place and this would suggest the pair will likely challenge key resistance at 132.00.