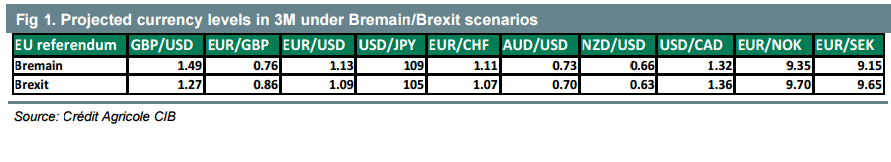

The impact of the EU Referendum goes well beyond the shores of the UK but impacts many other currencies. Here are the forecasts from Credit Agricole, with a thorough explanation:

Here is their view, courtesy of eFXnews:

The initial impact of a Brexit on EUR should be negative as fears about the growth outlook and the integrity of the EU will fuel expectations of more ECB easing. That weakness should manifest itself mainly vs safe haven, non-European currencies, however. We doubt that Brexit will precipitate the demise of the EU or the Eurozone and we do not think that the EUR-weakness will be sustained over the longer-term, however. In addition, portfolio outflows and earnings repatriation from the UK should support EUR/GBP while risk aversion could prop up the EUR against risk-correlated and commodity G10 currencies.

USD may well fare the best given its superior liquidity and the fact that a Brexit could delay but not derail future Fed tightening. This will also be consistent with the experience during the 1992-1993 ERM crisis when the USD rallied across the board, supported by risk aversion and growing rate hike expectations ahead of the 1994 Fed tightening cycle.

A Brexit will deal a blow to market risk sentiment and support the safehavens JPY and CHF, with the former likely to outperform the latter. Both may lag behind the USD over the longer-term, however, especially if there is further central bank action to prevent unwarranted FX appreciation, like further easing or outright FX interventions.

Brexit could trigger a bout of global risk aversion and weigh on AUD, CAD and NZD even though the impact should be less pronounced than in the case of the Scandies.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.