While the pound did make a huge rebound in the aftermath of the tragic killing of MP Jo Cox, Brexit is still a big threat. Here are two opinion about the potential BOE action and the range for next week. Fasten your seatbelts:

Here is their view, courtesy of eFXnews:

GBP: BoE To Cut Interest Rates To Zero If Brexit Or To Hike In Q1 ’17 If Bremain – Danske

In case of a Brexit we expect the BoE to ease monetary policy to support the economy. To be more specific, we expect BoE to cut the Bank Rate from 0.50% to 0.00% (currently, the BoE has ruled out negative rates but other central banks with negative rates did that previously as well) and resume the QE programme (APF). If needed, it could also ease credit through an extension of the ‘Funding for Lending Scheme’ (FLS).

In case of a Bremain, we expect growth to pick-up in H2 16 and we expect the BoE could hike in Q1 17 although risks are skewed towards a later hike.

GBP/USD: Range & Outlook Into The Final Week Before The Vote – BTMU

GBP/USD – BEARISH BIAS – (1.3800-1.4400)

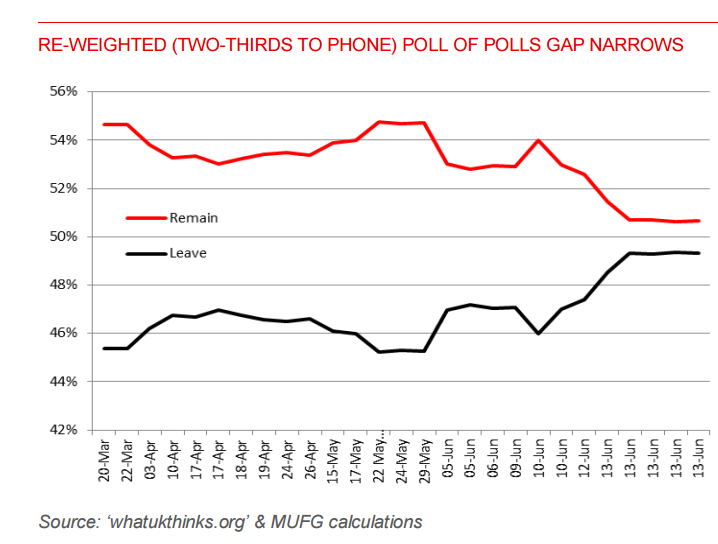

As can be seen from chart, the polls have tightened considerably and if the momentum continues we may well see ‘Leave’ ahead in most polls by the day of the referendum next Thursday. If that is the case, we would expect GBP/USD to be trading below the 1.4000 level as investors’ fears escalate.

The crucial objective for ‘Remain’ must be to get the focus to shift back to the economy where they have been strongest. The big event in the week ahead will be the last live TV debate taking place in Wembley Arena on Tuesday 21st. That will be the last real opportunity for each side to make their case and may prove important in shaping the final ‘don’t knows’. The positive in terms of reduced market volatility is the fact that the FOMC has maintained a cautious approach to additional monetary easing and that may limit dollar buying in the run up to the referendum.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.