Brexit or Bremain? This is a question the whole world is asking. If Brits vote to remain in the EU, we could witness a relief rally in the pound, euro, other risk currencies and stock markets. If Brits want out, the pound could plunge, the euro will follow and so will stocks. In addition, it could be the beginning of the end of the EU and the shock event that breaks the already fragile global growth. It is hard to exaggerate the importance of the historic event.

In this preview, we provide an update on the current polls and positioning, the potential outcomes and perhaps most importantly, the critical events to watch, separating the wheat from the chaff.

Update: UK leaves the EU – it is official – expect more crashes

Polls and positioning

An abundance of polls has been released in recent days. They have showed a move back towards Remain. but this is clearly a neck-to-neck situation. The Remain camp was leading until late May with 5-6%. Then Leave got a lot of back wind and led by 5-6% at some point. Remain regained some strength just before the tragic murder of Jo Cox and strengthened a bit more afterwards, but according to polls, it’s just too close to call.

Here are the main aggregate results:

- FT Brexit Tracker: 44% Leave, 43% Remain and that leaves 13% undecided.

- Number Cruncher Politics: Polls show 45% Leave, 44% Remain while the Central Proijection stands at 52% Remain, 48% Leave.

- What UK Thinks: Poll of Polls show 51% Remain, 49% Leave.

It just doesn’t get closer than that and well within all the margins of error.

So why are markets relatively calm? Most people think, including in this neck of the woods, that the undecideds will eventually stick with “the devil they know” – vote Remain to avoid uncertainty. That’s what happened with Scotland and also in last year’s general elections, the ruling Conservatives were reelected.

We think that the a small majority for Remain is the most likely outcome, something like 2-5% lead. Wounds will remain open for a long time, but the immediate implication will be a relief rally.

But nothing is certain until the full results are in.

Currency reactions

Also markets lean towards remain in the past week, meaning that a vote to leave would have a much bigger negative impact on the pound than the positive reaction on a vote to stay.

On Remain

- GBP/USD would likely rally a few hundred pips, possibly temporarily topping 1.50 before sliding to somewhat lower ground. At the time of writing, cable is at 1.4666 which is still relatively high, so gains could be limited.

- EUR/USD could top 1.15 but possibly slip back down under the strong line of 1.1460 once the dust settles. It will be a relief for Europe, but many problems still exist.

- USD/JPY could challenge the previous support line of 105.50. There will be less demand for safety, at least for a short time. The next moves will depend on US data and the actions of the BOJ.

- USD/CAD could fall below 1.2750 alongside a rally in oil prices. 1.2630 will probably not be reached at this time, as oil prices could have a limited rally.

- AUD/USD has room to advance towards 0.76 or even 0.7640, with a smaller “risk on” effect.

- NZD/USD has the wind in its back and could see 0.7250.

The event will move to the back-burner after a few days, but a sustained rally would need a huge majority in favor of Remain, no less than 55% to 45%.

On Brexit

The implications of such a shocker would be felt for long months as they could tilt the world into a recession, remove any chance of a Fed rate hike in the next year or so and trigger more issues in Europe.

- GBP/USD could fall quickly below the post crisis low of 1.35 and hit 1.30. From there it could bounce violently as well before resuming its downtrend and suffering for a long time.

- EUR/USD could quickly deteriorate a few hundreds of pips with 1.10 blowing out and perhaps only 1.0820, the March double bottom, working as support. Also here, a big bounce could follow and serve as a selling opportunity.

- USD/JPY could free-fall on safe haven flows. A test of the very round level of 100 could be seen. A correction here could be triggered mostly by the BOJ with 103 serving as the new line of resistance.

- USD/CAD has room to rise with falling oil prices. 1.3310 is a strong line, with 1.35 following.

- AUD/USD could slide towards 0.7140 in the initial fall, followed by an attempt on 0.70.

- NZD/USD would easily slip under 0.70 and need time to recover.

A coordinated move by central banks could limit the crashes in stock markets and currencies. We know there are talks going on in the background, but reaching an agreement and acting forcefully together is a tough task.

Critical EU Referendum Schedule

Here are the key events to look for

- Up to 6:00 GMT on Thursday: Last minute polls are released just before voting begins. It could add to choppiness. No poll publications are allowed when voting is underway.

- 21:00 GMT: Election day polls: As voting ends, we will get new opinion polls made on election day. These are NOT exit polls, but can well reflect what people actually voted. As with pre-voting polls, it could be too close to call.

- 21:00 GMT Unconfirmed: hedge fund exit polls. For several weeks, we have heard that various hedge funds have contracted polling firms to conduct large scale exit polls, similar to what TV networks do on normal elections. This is unconfirmed. As with the rumors of the existence of these exit polls, also the rumors about the results could be messy and trigger false breakouts.

-

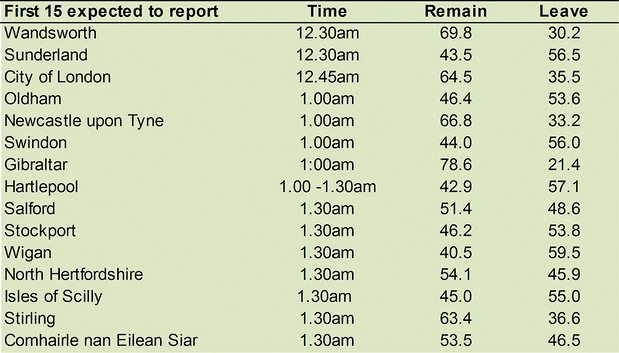

23:30 GMT First real results from Wandsworth and Sunderland expected. The chart below (courtesy of the University of Bristol, JP Morgan and The Guardian) shows the voting tendency among the first 15 areas to vote, with the times. In Wandsworth, the expected outcome is nearly 70% Remain and 30% Leave. If Remain gets more than 70%, it could imply a general vote to Remain. If it’s under, it’s a lean for Leave. In Sunderland, Leave is expected to win by 56.5% to 43.5%. If Leave gets for example over 60%, it’s an indication for Leave, and something closer to a dead heat would imply a gain for Remain. The same logic can be applied to the City of London results which are due at 23:45 GMT and the bulk of areas publishing their results between 00:00 and 00:30 GMT.

-

00:00 to 3:00 Most real results will flow in: If the trend is clear, we will already have a clear reaction still well within the Asian session and a long time before markets open in London. Every county could swing the reaction. However, if the voting is indeed as close as polls suggest, it will be longer hours of choppiness.

- 1:00 Wrexham reports: Considered a bellwether.

- 1:30 Caerphilly counts: Also a bellwether.

- 2:00 Lancaster reports: Also this city could be very balanced.

- 3:00 Result projection?: The BBC estimates it could call the result, but this depends on how close things are. 88 areas are reporting at this time.

- 4:00 90% areas will have reported. This would be another opportunity to call the result.

- 6:00 Last result coming in: Most of the late areas to report are more euro skeptic / Leave leaning ones.

- 7:00 GMT: Full reaction: European markets are scheduled to open (unless they closed by emergency procedures) and we will get the full swing. We cannot rule out a “:buy the rumor, sell the fact” in case the Remain camp is seen as winning at an early stage at night.

Conclusion

The EU Referendum is a huge event for the whole world and is closely watched. Financial firms are bringing more staff in, central bankers are observing things closely and movements can be huge. Trade with care and with less leverage. You may already be limited by your brokers: here we have Brexit updates from 41 brokers (and counting)

Trade responsibly and good luck.

More: Brexit or Bremain – all the updates