The UK decided to leave the EU in a move that shocked global markets. This has wide implications beyond the shores of the UK and the EU. It could even tip the world into a recession.

There are many open questions after the UK vote to leave. How will trade continue between the UK and the rest of the continent? Will the BOE and the ECB provide stimulus? How will the Brexit be implemented?

The warnings about a recession in the UK do not seem exaggerated at all, at least in the short term. In the euro-zone, growth was strong in Q1 but markedly weak in Q2. This could also be the breaking point.

Outside the old continent, China continues slowing down and Japan is finding it hard to generate growth. Commodity exporting nations are already struggling.

All in all, the global economy is fragile and this could be a breaking point.

US breaking point?

The United States economy was already growing quite slowly. The recent jobs report for May could have been a one-off, but also April’s number was weak. Inflation never really seemed to pick up.

On this background, we would have needed a recovery in the next jobs report and other positive economic indicators in the US to justify a hike in July, probably the last chance before the US presidential elections. However, data released after the Brexit does not support it. Durable good orders fell by 2.2%, much worse than expected and core orders also missed expectations with a fall of 0.3%.

But adding the risks of Brexit, this could certainly be a potential breaking point. No, the US economy will probably avoid an outright recession: it is hard to see two quarters of contraction.

But this cannot only happen on its own. The Federal Reserve, which almost always errs on the side of caution, could certainly provide support. Yellen and her colleagues are unlikely to raise rates any time soon.

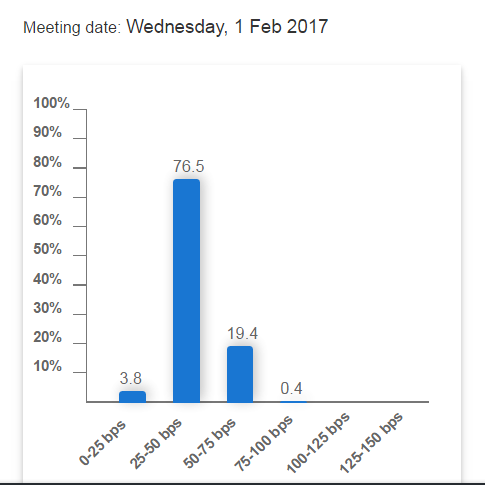

It is quite reasonable to think that raising rates in the next 12 months is out of question. The implied probability for a hike all the way to February is under 20%. Things can change and improve, but the Fed is likely to be ever more cautious.

Fed rate cut?

This cannot be ruled out. The FOMC would prefer not to reverse policy: policymakers took their sweet time with raising rates in December. It was the first time in a decade and came after huge preparations.

However, when the going gets tough, the tough get going. And in this case, the Fed could go soft in order to support the economy: at home and overseas.

If things deteriorate, we could see a rate cut in September, when the Fed has its next decision accompanied by a press conference. A rate cut in July could be seen as jumping the gun. Perhaps letting markets calm on their own would be better.

But if things worsen quickly, also a July cut or an emergency move cannot be ruled out.

What do you think?

More: Brexit – all the updates

The rise of the US dollar already serves as tightening. A stronger dollar means curbing of exports and cheaper imports – lower inflation. Here is the Brexit reaction: