The Brexit fallout continues and the collateral damage is also felt in the euro. Here are downwards looking forecasts.

Here is their view, courtesy of eFXnews:

Post-Brexit: EUR/USD Towards 1.07-1.09 Before Bottoming Out – Danske

Don’t Buy EUR/USD At Current Levels – Credit Agricole

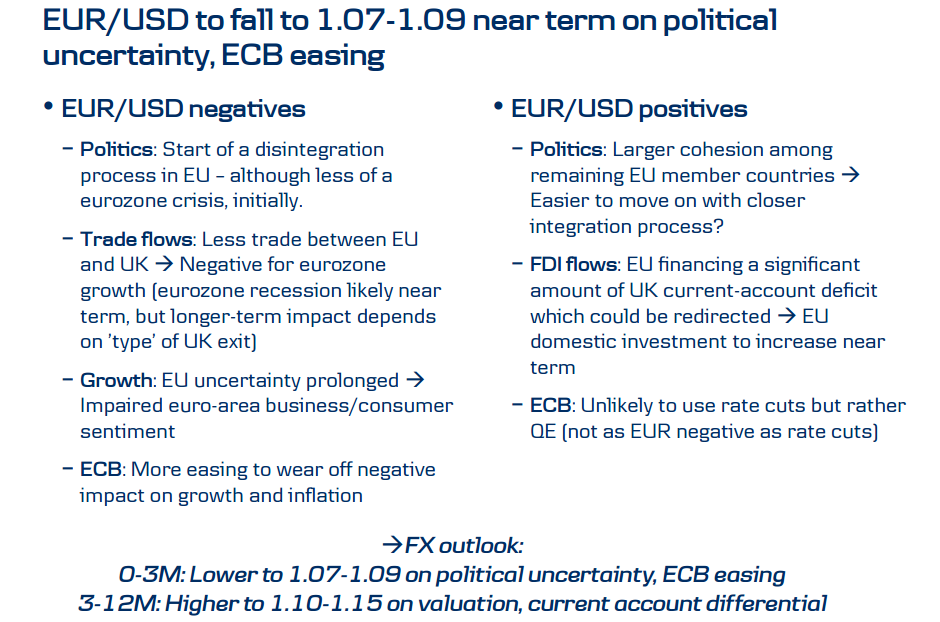

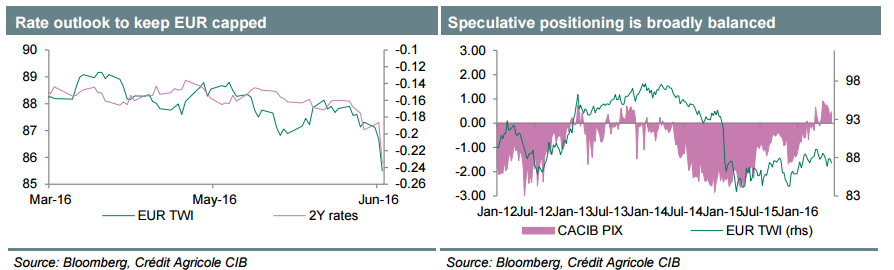

We expect the single currency to remain subject to downside risks. This is especially true as the latest UK-related development is likely to increase political uncertainty in the EU further and as more muted growth prospects should keep the ECB in a position to consider additional policy action if needed. As reiterated by ECB President Draghi this week, downside risks to growth and inflation remain significant and uncertainty high. At the same time he stressed that more can be done if needed. Although it remains too early to expect the central bank to consider further policy measures, there is no scope of rising rate expectations anytime soon. In an environment of EU specific risk aversion, we believe too that the EUR should remain positively correlated with risk aversion.

As a result of the above outlined conditions we advise against buying the EUR, especially against currencies such as the USD. It may be true that increased global growth uncertainty should prevent the Fed from tightening monetary policy anytime soon.

However, at the same time the USD is behaving more as a safe haven currency in the current environment. In terms of data next week’s main focus will be on preliminary June CPI, which is unlikely to confirm improving price developments.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.