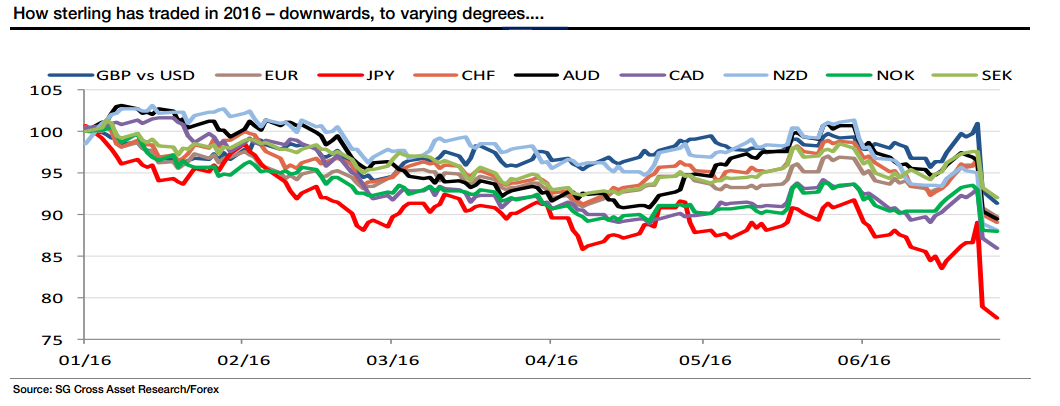

Following Brexit, the pound suffered quite a bit. However, today we are seeing some stabilization. Can it recover? Here are views from Goldman Sachs and SocGen:

Here is their view, courtesy of eFXnews:

GBP/USD, EUR/USD, EUR/GBP: Post-Brexit Targets – Goldman Sachs

The decision of the majority of the UK voters to Leave the EU changes in a fundamental way the outlook for Sterling and has economic implications which are sizable for the European economy, but less so for places like the US that are further away.

In this FX Views, we mark-to-market our forecast for the British Pound, where up until this point we had anticipated substantial appreciation against the Euro in coming years.

Our new forecast for EUR/GBP is 0.85, 0.82 and 0.78 in 3, 6 and 12 months (from 0.76, 0.74 and 0.70 before), reflecting a weaker outlook for Sterling over the coming year.

In the medium term, we think the Pound regains some strength, with EUR/GBP falling to 0.70 on a 24-month horizon (versus 0.65 in our previous forecasts) and then to 0.65 on a three-year horizon (unchanged from before). We are for now keeping our EUR/$ forecast unchanged, but as we argued in the run-up to the UK referendum, we believe the “leave” vote is a material negative shock to the Euro zone economy, which was struggling to reflate even before the recent turn of events. Our existing forecast of 1.12, 1.10 and 1.05 in 3, 6 and 12 months therefore has clear downside risk, once the near-term bid for the Euro as a result of risk aversion – for which there was clear evidence on Friday – abates. The risk is now that we reach our 24-month forecast of 0.95 and our 36-month forecast of 0.90 sooner, in particular if the doves on the ECB Governing Council shift once again to more proactive easing.

Our GBP/$ forecast, given our for now unchanged EUR/$ forecast, is therefore 1.32, 1.34 and 1.35 on a 3-, 6- and 12-month horizon, with our 24- and 36-month forecasts being 1.36 and 1.38, respectively.

Post-Brexit: GBP/USD Towards 1.25, EUR/USD Towards 1.08, EUR/GBP Towards 0.85 – SocGen

The extent of the uncertainty that now clouds the UK’s economic and political outlook is hard to exaggerate. The Government is in limbo ahead of a Conservative Party leadership contest. The opposition is in chaos. The rest of the EU would like negotiations on the UK’s exit to begin but they have no-one to negotiate with. Uncertainty is negative for the UK economy, for investor confidence and obviously, for the pound.

Sterling has now fallen by 9% against the US dollar since the eve of the UK referendum, and we look for an eventual move in GBP/USD to 1.20- 1.25.

EUR/GBP may well trade above 0.85 in the process, though the damage to the European economy shouldn’t be under-estimated. The Bund/Treasury spread, in real and nominal terms, isn’t pointing to Euro weakness yet, even as Bund yields head deeper into negative territory, but US yields are likely to stabilise before European ones and EUR/USD is likely to move down to 1.08 in the weeks ahead.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.