US New Home Sales indicator is released monthly, and provides analysts with important data the health and direction of the housing sector. A higher reading than the market prediction is bullish for the dollar. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 14:00 GMT. Indicator Background US New … “USD/JPY: Trading the US New Home Sales”

Month: June 2016

Swiss Franc Joins Rally vs. US Dollar, Unable to Beat Euro

The Swiss franc rallied together with other currencies against the US dollar today, but the Swissie was unable to outperform the euro, falling against the shared 19-nation currency. The Swiss economic outlook improved as was shown by the ZEW-CS-Indicator for the economic sentiment in Switzerland that increased from 17.5 to 19.4 in June. The report said: Survey participants show a strong agreement regarding the assessment of Switzerlandâs current economic situation: 93.8 per cent of analysts … “Swiss Franc Joins Rally vs. US Dollar, Unable to Beat Euro”

GBP, JPY: Expected Trading Targets On A Leave / Remain

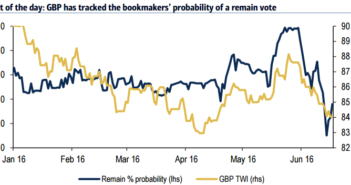

The Brexit / Bremain vote is upon us, with wide ranging implications. Here are the expected moves according to BTMU: Here is their view, courtesy of eFXnews: The opinion polls that had a clear momentum in favour of ‘Leave’ over recent weeks have indicated a shift with weekend opinion polls showing support has shifted back in favour of … “GBP, JPY: Expected Trading Targets On A Leave / Remain”

Helpful Fundamentals Make Australian Dollar Stronger

The Australian dollar climbed today thanks to helpful fundamentals, like the rise of crude oil prices and the weakness of the US dollar. Yesterday’s speech from Federal Reserve chief Janet Yellen showed cautious stance of US policy makers, which was detrimental to the greenback and beneficial to other currencies. Also released yesterday, minutes of the Reserve Bank of Australia policy meeting demonstrated a neutral stance in regards to monetary policy. As for today’s events, the rally of crude … “Helpful Fundamentals Make Australian Dollar Stronger”

EUR/USD, USD/JPY: Targets On Brexit – BofA Merrill

While most of the Brexit focus is on the pound, the euro gets carried away with Brexit talk and the yen is a safe haven currency. Here is the potential impact according to Bank of America Merrill Lynch: Here is their view, courtesy of eFXnews: We expect both GBP/USD and GBP/JPY to be the major … “EUR/USD, USD/JPY: Targets On Brexit – BofA Merrill”

How Should Traders Get Ready for Brexit?

With the referendum vote over the UK’s future membership of the EU being held on Thursday, traders are preparing for the possibility that the UK electorate will vote to leave the EU. With the polls showing that the decision rests on a knife’s edge, traders are well advised to be managing potential risks. There are … “How Should Traders Get Ready for Brexit?”

USD/CAD: Trading the US Crude Oil Invetories

US Crude Oil Inventories measures the change in the number of crude barrels held in inventory. The report is published each week. A reading which is higher than the market forecast is bullish for USD/CAD. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Wednesday at 14:30 GMT. Indicator Background As Canada … “USD/CAD: Trading the US Crude Oil Invetories”

EUR/USD: Parity on Brexit; Still 1.10-1.15 on Bremain –

The pound is not alone in its reactions to the British EU Referendum. After all, it’s the EU and the euro-zone at stake here. The team at NAB have clear opinions on the potential outcomes: Here is their view, courtesy of eFXnews: EUR to quickly follow GBP lower on Brexit: While market focus has been … “EUR/USD: Parity on Brexit; Still 1.10-1.15 on Bremain –”

British Referendum on EU membership: What is Ultimately at

British voters face a historic and critical choice about the future of the United Kingdom and the European Union on Thursday June 23. Great Britain will organize a referendum where its citizens have the ability to answer whether the United Kingdom should remain a member of the European Union or whether the U.K. should leave … “British Referendum on EU membership: What is Ultimately at”

If Brexit, Buy CHF Vs EUR & GBP; If Bremain,

The Breferendum is just days away. Here is how to trade it according to Goldman Sachs: Here is their view, courtesy of eFXnews: Markets remain focused on the UK referendum and its implications for asset prices. In the past two weeks, ‘Brexit risk premia’ have been priced into UK and foreign assets, and we expect … “If Brexit, Buy CHF Vs EUR & GBP; If Bremain,”