We have seen how GBP/USD crashed under 1.30 and EUR/USD is carried along in a second big wave of post-Brexit selling. The team at Goldman Sachs provides new deep targets:

Here is their view, courtesy of eFXnews:

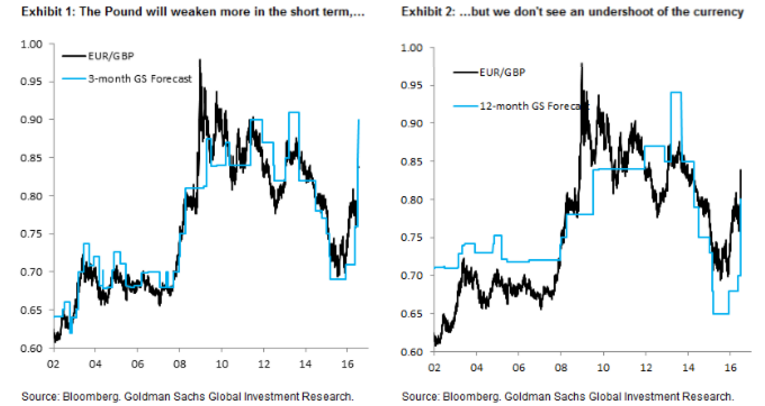

Following the Brexit surprise, we revised our Sterling forecasts weaker, but – amid lots of doomsday scenarios for the Pound – resisted the temptation to forecast a free-fall. Now that markets have settled somewhat, we are switching to forecast a second leg of weakness for the Pound, as the Bank of England’s policy response drives the currency weaker.

…The market is not discounting the easing effect of asset purchases, the persistence of easier monetary conditions in the UK, and the US-UK monetary policy divergence that we expect nearly as much as it should.

Next week, we expect the BoE to provide a further indication of the scope of the conventional and unconventional monetary policy measures we expect. This will be the catalyst for a further downward move in Sterling.

…Turning to the Euro, the negative growth spill-overs that our economists expect is a cumulative 0.5 percent over two years (compared with 2.75 percent for the UK). This slowdown implies downside risks to our already low inflation projections and puts additional pressure on the ECB to step up the pace of monetary accommodation.

Our economists expect an extension of the asset purchase programme through 2018 and a shift away from the ECB’s capital key. The latter change could reduce market worries over Bund scarcity and, in our view, could lead to more EUR/$ weakness.

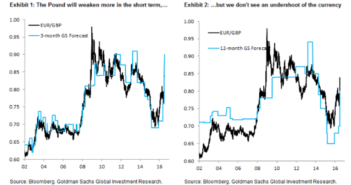

Our new EUR/GBP forecast is 0.90, 0.86 and 0.80 in 3-, 6- and 12-months (from 0.85, 0.82 and 0.78 previously), i.e. builds in more Sterling weakness in the near term. We also revise our EUR/$ forecast to 1.08, 1.04 and 1.00 in 3-, 6- and 12-months (from 1.12, 1.10 and 1.05 previously).

These changes imply a new path for GBP/$ of 1.20, 1.21 and 1.25 in 3-, 6- and 12-months, i.e. substantially more front-loaded downside than in our forecast in the immediate aftermath of the Brexit vote (1.32, 1.34 and 1.35).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.