UK PM Theresa May has entered Downing 10 and appointed Phillip Hammond as Chancellor of the Exchequer. Until they both get used to their new roles, the pound moves mostly on the BOE.

Here are two opinions on the next direction of the pound:

Here is their view, courtesy of eFXnews:

GBP/USD Squeeze Won’t Go Beyond 1.35 But The Context Matters – SocGen

I’m struck at the enthusiasm of all and sundry to tell us that European and US growth rates will hardly be affected by the UK post-referendum slowdown.

That flies in the face of the increased correlation of major economies’ growth rates in an ever more connected world. You can’t have it both ways – if the world thrives post-Brexit, the UK won’t suffer that badly. Particularly if there is a strong fiscal policy response.

For now, the sterling short-squeeze goes on. I doubt GBP/USD can get through 1.35, but the context matters. The June 24 peak was 1.5020 (albeit in middle-of-the-night liquidity) and the low is just above 1.28, so a 50% retracement of the fall would be around 1.39….

SocGen maintains a short GBP/USD from 1.3750*

GBP Remains A Sell – Morgan Stanley

Yesterday’s GBP rebound triggered by hopes the UK economy may not suffer full ‘Brexit blues’ as government stability returns with the steady hand of incoming PM Theresa May has helped the JPY to weaken too as GBP has been an important carry vehicle of Japan based retail investors.

However, we think the GBP rally will run out of steam once investors learn that the economy is likely to slow down from the investment side, weakening employment and then finally consumption. Yesterday’s upbeat headlines suggesting strong post Brexit retail demand provided the excuse for a sharp GBP short-covering rally, but the trend remains down. Note that we believe it is too early to make consumption related judgements from so few data points.

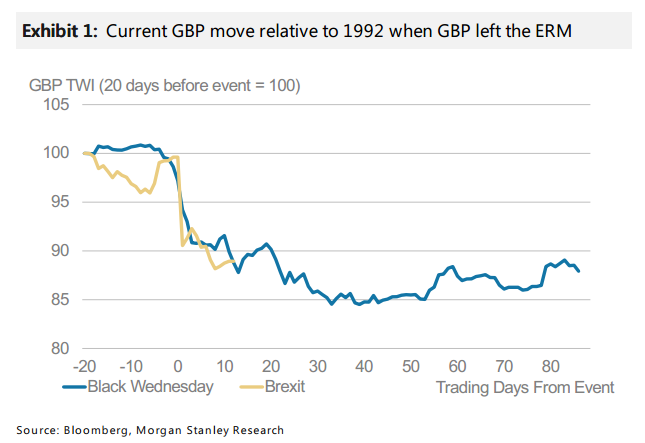

The chart below shows that previous episodes of GBP weakness developed similar patterns compared to yesterday’s move but did not indicate a trend reversal.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.