Mario Draghi and his colleagues are back with a rate decision, the first one after Brexit and amid crises in Italian banks. Here are previews from Citi, RBS and Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

EUR/USD: Scenarios & Trades Into The ECB – Citi

What can we expect from the ECB? Rates decision 12:45pm (7:45 NYT) / Press conference 1:30pm (8:30 NYT).

Base case: 75% probability, EURUSD -0.75%.

Rates & APP remain unchanged, but a dovish press conference, enough to keep September “live”. This is consistent with current market expectations and the Citi Economics view. Short rates suggest a 40% probability of a 10bp deposit rate cut by the September meeting and 80% by December meeting.

Dovish ECB: 15% prob, EURUSD -3.0%.

Pre-committing to September would be the dovish surprise. Watch Draghi’s language. This could take the form of language used by Draghi in January 2015 when the GC signaled the March QE expansion. “…signals coming from the monetary analysis confirmed the effectiveness of the monetary policy measures in place and the need to review and possibly reconsider our monetary policy stance at our next meeting in early March in order to secure a return of inflation rates towards levels below, but close to, 2%.”

Hawkish ECB: 10% probability, EURUSD +2.0%.

This would be the non-committal ECB, i.e. a neutral press conference, unchanged statement, coupled with very little discussion of September or increased risks. In actuality the ECB wouldn’t be hawkish – just less dovish than the market – but EUR would rally. EURUSD expected value over the ECB: -0.82%. Hence we are bearish EUR over the event.

What can we expect from EUR?

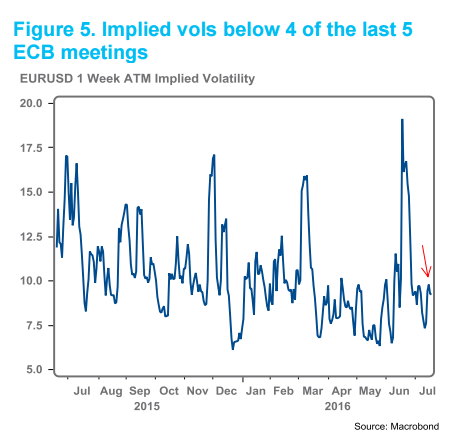

A quick, abrupt move – and then more waiting. We are short EUR over the event based on our expected value calculations and positioning/sentiment we infer from EUR flows. Still, we have to point out that 1-week EURUSD vols are at the lows. The market has VERY few expectations into ECB that any move lower in EUR can be sustained enough to break ranges.

ECB On Hold; To Leave Door ‘Wide Open’ For Further Easing – RBS

The ECB is unlikely to change any of its key policy settings on Thursday. It would seem strange if the ECB were to ease policy – for UK-related reasons – a few days after the Bank of England decided to leave its monetary policy on hold. And there has been little evidence of any financial market or broader macroeconomic destabilisation from the UK’s Brexit decision so far. Periphery bond markets in particular have been extremely well behaved.

However we believe the door will be left wide open to some further easing in the coming months. Recent UK-related events have tuned investors’ attention in to some of the area’s fault-lines and there are several reasons to remain cautious about how the region’s economies will evolve from here. Debt-related challenges in the Italian banking sector and broader issues concerning political and geopolitical stability are clearly some of those major fault-lines. Underlying growth and inflation momentum in the meantime is already pretty weak and market-based inflation expectations are hovering close to record lows.

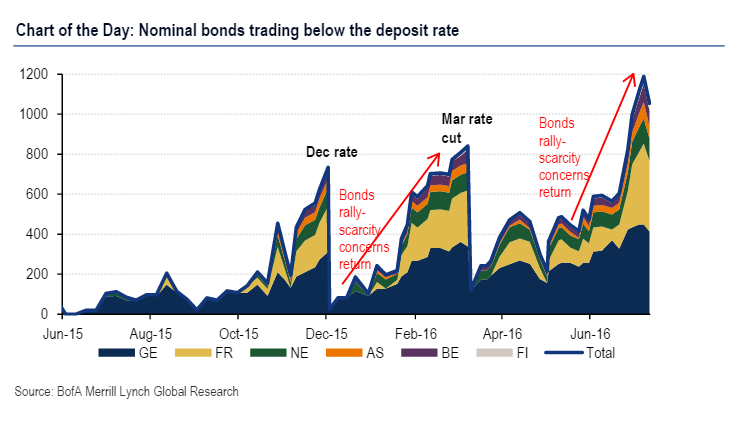

Exactly how the ECB might ease policy again will be the main feature of this month’s meeting amidst growing operational difficulties in the PSPP and concerns about the profitability of the region’s banks. Options for a re-design of the PSPP include a change in the Capital Key requirement, a change in issue/issuer limits, a lift of maturity restrictions or allowing the purchase of bonds that yield less than the depo rate. We do not expect comprehensive changes this week but we do expect Draghi to tell us the ECB is studying these issues in committee and that September is the most likely date for a more substantive change.

We think those changes will accompany a further loosening of policy at that meeting on 8th September. We specifically expect a 10bps cut in the deposit rate (from -0.4% to -0.5%) and a €20-25 billion up-lift in the APP to be enacted at that time.

ECB To Pre-Sell September Easing; No Strong EUR Moves Expected – BofA Merrill

Upon meeting on 21 July, resilient markets after the Brexit vote will, in our view, allow the ECB’s Governing Council to stop at simply delivering hints at an imminent additional layer of stimulus on 21 July, reserving hard announcements for September. This would coincide with the release of new inflation forecasts, which we think will continue to be inconsistent with a return to price stability within a reasonable policy horizon.

We have no doubt continuing QE beyond March 2017 is necessary. Beyond the flat inflation outlook, we think financial and political stability risks in the periphery warrant continuous support from the central bank. At the same time we agree negative yields in the long end of the curve in core probably are counterproductive.

This calls for a technical reconfiguration of QE, with some liberties taken with the current implementation of the capital key. Upping the language from “close monitoring” to “vigilance”–using the old Trichet-era code words–would be an easy way to “pre-sell” September, but we will not be surprised if Draghi chooses to be more blunt and simply states that “a revision of the stance is imminent”.

EUR risk slightly to downside.

Even barring any hard announcements, we expect Draghi to start preparing markets for QE extension after March 2017, which would be negative for the Euro keeping everything else constant. Although the market already expects QE extension, relaxing some of the QE constraints to keep QE open ended—such as abandoning the capital key—is not fully priced in yet, in our view. As such, the EUR impact of the meeting this week will depend on how strong Draghi’s hints on QE extension are going to be and any details on how the ECB will address the existing QE constraints.

Having said that, we do not expect a strong Euro move for now, and with the pressure off the ECB to over-deliver next week, the Euro may remain broadly range-bound.

The Euro has found support in the rally in risk assets and the market repricing of the next Fed hike to as far as 2018. In our view, a sustained move of EURUSD below 1.10 needs either a sharp downward equity market correction, or stronger US data that force the Fed to hike this year or early 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.