The Federal Reserve left the rates unchanged and seemed not to rock the boat. But the upbeat outlook left some speculating about a move in September. Here are various opinions:

Here is their view, courtesy of eFXnews:

Quick Take: Fed Statement – CIBC

A month of better data wasn’t enough to radically change the Fed’s tune, particularly with FOMC members likely feeling chastened after a series of flip-flops on the rate outlook. July’s statement didn’t, of course, deliver a rate hike, and held on to much of the text from June. Still, it had to give a nod to the improvement in the last employment report, but also went on to argue that “near term risks to the economic outlook have diminished”. George also returned to her earlier position as a dissenter calling for a hike now.

While these subtle changes do suggest some progress towards a rate hike, there’s nothing here that points to September, and we’re retaining our projection for a hike in December. Slightly bearish for Treasuries, and bullish for USD given that the market isn’t that well priced even for a December hike.

July FOMC: Less To Worry About But We Still See September Hike Unlikely – BofA Merrill

Near-term risks have diminished

The FOMC statement was a touch more upbeat than in June, but it was not a game-changer. The FOMC noted that near-term risks to the economic outlook have diminished even though they are continuing to monitor global economic and financial developments. In other words, the FOMC is acknowledging the post-Brexit calm in the markets, but is still cognizant about the uncertainties in the global economic outlook. In our view, this is setting the stage for another hike while making it clear that it is not imminent. We continue to believe that a September hike is unlikely, but expect conditions to be met by December to justify a rate hike, assuming no additional negative shocks.

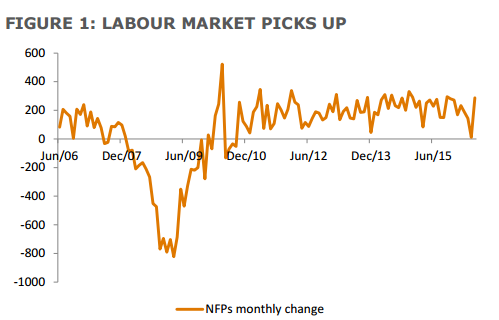

All about jobs

The FOMC sounded more upbeat about the health of the labor market, noting that payrolls and other labor market indicators point to some increase in labor utilization. Although the pace of job growth has slowed – averaging 172,000 on a six month basis – the Junejobs report made it clear that it was not nearly as weak as the April and May data had implied.

The FOMC made no meaningful changes to its language around inflation expectations, claiming that “most survey based measures…are little changed, on balance, in recent months.“ While it is true that most survey measures have been stable, they are trending in the lower end of the range. Moreover, market-based measures of inflation expectations remain depressed which should create some discomfort for the Fed. Given the uncertainty about the amount of slack in the labor market and the trajectory of wage growth, it seems that Fed officials are still more concerned about downside than upside risks to inflation.

Now we wait

The next two big events for the Fed are the FOMC minutes on 8/17 and Chair Yellen‘s speech at Jackson Hole on August 29. The minutes should provide more detail on how Fed officials are measuring risks and the degree of concern about the global outlook. Before the minutes are released, we will likely hear from an assortment of Fed officials – as always, we advise caution placing too much emphasis on the commentary, especially from the more extreme members.

July FOMC: Fed Leaves The Door Ajar For A Hike As Soon As September – Danske

As expected FOMC maintained the federal funds target range unchanged at 0.25%-0.50%. Compared to the last meeting when the decision was unanimous, Fed’s George dissented by voting for a Fed hike. As this was one of the small meetings without updated ‘dots’ and a press conference, focus was on the statement. As expected the FOMC recognised that the economy grew at a moderate pace in Q2 (especially due to strong consumer spending) and employment growth rebounded in June after the slowdown in April and May.

Also FOMC repeated that it ‘continues to closely monitor inflation indicators and global economic and financial developments’ as expected. A new sentence attracted a lot of attention as the FOMC stated that ‘near-term risks to the economic outlook have diminished’, meaning that the statement is more hawkish than the statement in June despite the UK voting to leave the EU just a week after the June FOMC meeting.

Unfortunately FOMC statements are not very detailed and we have to wait until the minutes or upcoming Fed speeches to get more information about how the Fed sees the world. Although we expected risk to be tilted towards a more hawkish Fed, we had expected the FOMC to stay cautious due to Brexit as the minutes from the last FOMC meeting stated that the Fed would have to ‘wait for additional […] information that would allow them to assess the consequences of the U.K. vote for global financial conditions and the U.S. economic outlook’.

With the inclusion of this sentence, FOMC leaves the door ajar for a hike later this year, perhaps already in September.

July FOMC: A Nod In September’s Direction – Barclays

We view the FOMC statement as somewhat more hawkish than we had expected, although our expectation of changes to the statement closely mirrors those in the actual release.

The tone of the statement reaffirms our view that the FOMC is likely to raise its policy rate at the September meeting, so long as the labor market continues to perform. The committee remains concerned about inflation, inflation expectations, and the international environment; however, these concerns are no more pressing than they were at the time of the December meeting, at which point the FOMC increased its policy rate and signaled four additional hikes in 2016.

Although the statement was a bit of a hawkish surprise given how dovish the committee seemed in June, in our view, the statement is consistent with the committee’s consistent message that they plan to hike rates at least one more time this year. In June, only six members preferred one hike this year rather than two; the median dot in the “dot plot” still called for two rate hikes this year. We wrote at the time of the June meeting that the committee was likely pushed in a dovish direction primarily by the weak May payroll report. We said that their views would evolve with the June, July, and August employment reports; this evolution appears to have occurred.

We expect to see even firmer signaling from Chair Yellen during her appearance at Jackson Hole on August 26. By this date, the committee will have Q2 GDP, July employment, and observed market reactions to anticipated easing by the BOJ (July) and BOE (August) in hand. With that data in hand, she will likely feel even more comfortable with the underlying state of the economy and the likelihood of a September rate hike.

July FOMC: Setting The Stage For A September Hike – BNPP

The FOMC kept rates unchanged at its 26-27 July meeting, as widely expected. The statement evolved in the way we had expected and if anything, went a little further in preparation for a hike. We think the statement sent a clear warning sign that a hike could be on the horizon as “near-term risks to the outlook have diminished.” The odds of a September hike look better than even, and it seems as though the Fed is preparing for one as long as the data fall in line. We expect Fed communication to shift further over the coming weeks, with data releases doing most of the work. Upcoming Fed speeches, the minutes of the July FOMC meeting, and Yellen’s Jackson Hole speech will all be important.

The Fed just lowered the bar jobs need to achieve to motivate the next hike. Overall, this increases our confidence in our change in view last week from no change in Fed funds to forecasting a hike in September. Upcoming speeches and the minutes will likely shift market expectations in our direction. Payrolls are also expected to be supportive – we expect 175k in the next report, which is comfortably above the level we now think is the threshold for a hike – around 130k.

We continue to see a good odds of a September hike with a second being partially priced in for December.

We do not expect a December hike to be delivered as a September hike will likely tighten financial conditions and we expect a medium-term outlook which is more pessimistic than the Fed’s.

July FOMC: The Watching And Waiting Game Continues – ANZ

As expected, the FOMC upgraded its assessment of the US economic climate and left interest rates unchanged at the July policy meeting.

Markets will now look to next month’s data and Yellen’s speech at Jackson Hole on August 26 in trying to assess the timing of the next Fed move. The benign interest rate climate is positive for risk and supports the ongoing hunt for yield, which has benefitted EM recently.

The statement implied that the recent positive risk environment should continue. If the economy holds up or accelerates, that plays into the hands of gradual rate rises and strength in the dollar, especially against the backdrop of anticipated easing overseas. For risk assets, confirmation that rate increases will be gradual should continue to prove supportive.

The watching and waiting game continues. There is a wave of central bank meetings over the next week and arguably they hold more significance for markets given risks of a post-Brexit growth slowdown in the UK and the concerns over low inflation elsewhere.

dollar visual

dollar visual

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.