US dollar is experiencing choppy performance today as risk appetite battles with the fact that expectations for a Fed rate hike are on the rise again. US dollar is mostly lower against its major counterparts today, however. There hasn’t been a lot of movement as a new week starts and Forex traders evaluate the latest round of data. Earnings continue to roll in, and they are solid. As a result, stocks are … “US Dollar Performance Choppy in Forex Trading”

Month: July 2016

EUR/USD: Trading the German ZEW Economic Sentiment

German ZEW Economic Sentiment is based on a monthly survey of institutional investors and analysts and their views of the German economy. A reading that is higher than the market forecast is bullish for the euro. Update: German ZEW Sentiment goes negative -6.8 – Brexit driven Here are all the details, and 5 possible outcomes … “EUR/USD: Trading the German ZEW Economic Sentiment”

Will EUR/USD fall this week? 2 opinions

EUR/USD slid towards the end of the week on the news from Turkey, but basically remains entrenched in range. What’s next for the pair? Here are two opinions: Here is their view, courtesy of eFXnews: EUR/USD: A Slow Grind Lower Towards 1.08 En-Route To 1.05 – Deutsche Bank EUR/USD weakened moderately following the Brexit outcome but … “Will EUR/USD fall this week? 2 opinions”

Terror attack could impact GBP more than EUR

A villain murdered more than 80 people celebrating France’s Bastille Day in Nice, southern France. The horrific stampede is clearly an act of terror and it joins previous attacks in Paris and in the Brussels, Belgium. France has extended the state of emergency hours after President Hollande announced the planned removal of this measure. We also heard that … “Terror attack could impact GBP more than EUR”

Australian Dollar Climbs, Ignoring Disappointing Employment

The Australian dollar gained against the US dollar and the Japanese yen today even though employment growth trailed forecasts. The likely reason for the currency’s strength was the policy decision of Great Britain’s central bank. Australian employers added 7,900 jobs in June from the previous month, missing market expectations of an increase by 10,100. The unemployment rate ticked up from 5.7% to 5.8%, in line with predictions. The surprise decision of Britain’s policy makers … “Australian Dollar Climbs, Ignoring Disappointing Employment”

Sterling Jumps After BoE Delays Monetary Easing

The Great Britain pound climbed today after the Bank of England surprised markets, leaving its monetary policy unchanged. The BoE preferred to keep its main interest rate unchanged at 0.5% with just one person voting for a cut. It was a huge surprise to market participants as they were counting on policy easing. The central bank signaled that it is likely to ease the policy in August: The MPC is committed to taking … “Sterling Jumps After BoE Delays Monetary Easing”

Orbex and LUM University, Italy announce partnership

Cyprus based forex broker Orbex announces a strategic partnership with LUM University from Italy. More details in the official press release: Limassol, July 14, 2016 – Orbex, an innovative leader in online forex trading, today announced a strategic partnership with LUM Jean Monnet University, an Italian private university, known worldwide and highly regarded as a centre for … “Orbex and LUM University, Italy announce partnership”

Upbeat Forecast, Higher Oil Prices Help Canadian Dollar

Canadian dollar is getting a little help today, thanks to a recent upbeat forecast from the Bank of Canada, and thanks to improving oil prices. Loonie is mostly higher today, and there are hopes that the currency can maintain some of its recent advances going forward. The Bank of Canada recently held its interest rate unchanged, helping fuel speculation that the economy is on the right track. Policymakers also made … “Upbeat Forecast, Higher Oil Prices Help Canadian Dollar”

EUR/USD: Trading the University of Michigan Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 14:00 GMT. Indicator … “EUR/USD: Trading the University of Michigan Consumer Sentiment Index”

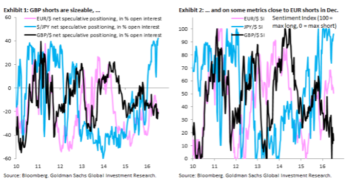

GBP: Positioning & Momentum Signal Ahead Of BoE –

The recent rise in GBP/USD makes us suspect that markets may be pricing a no-cut. What is the positioning? Here is the opinion from Goldman Sachs: Here is their view, courtesy of eFXnews: A persistent preoccupation of the foreign exchange market is positioning, especially ahead of key risk events like tomorrow’s Bank of England meeting. Exhibit 1 … “GBP: Positioning & Momentum Signal Ahead Of BoE –”