In the past 5 days, there may have been a big shift in the standings in the US presidential elections. A mostly successful Democratic convention and outlandish statements by Trump, even by his own terms, have shifted the polls. The attacks of Donald Trump against the bereaved parents of a fallen soldier may be a big moment that could cement a victory for Hillary Clinton.

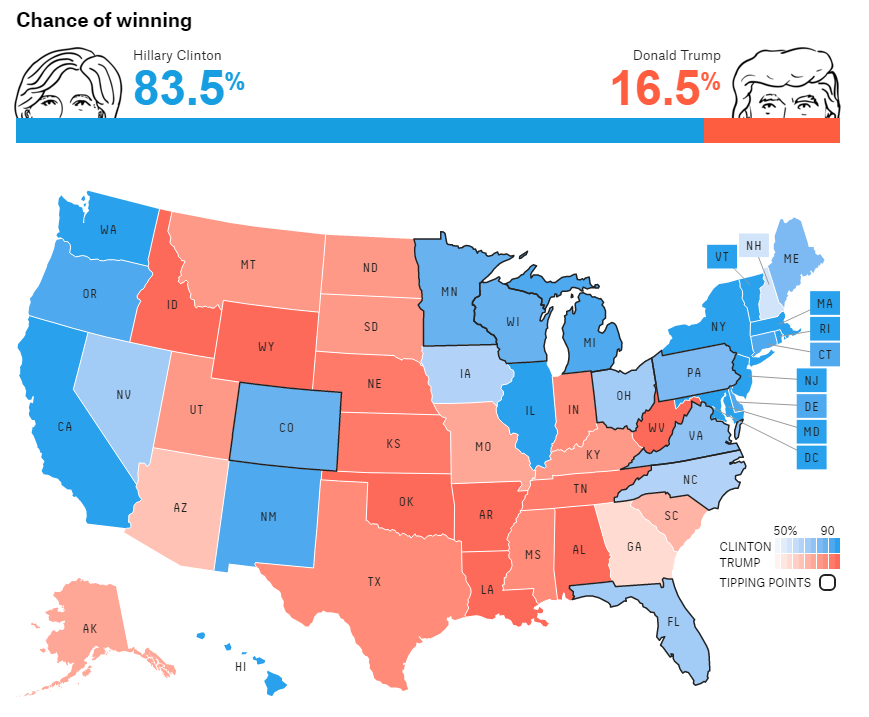

Poll aggregators such as RealClearPolitics are showing a swing towards Clinton in the post-conventions aftermath. Nate Silver’s FiveThirtyEight models show a 66-68% chance for a Clinton victory in the more conservative models. The Nowcast model which takes into account only the most recent swings has swung from 44% chance for Clinton to a landslide 83.5% of her winning the White House.

Depressed Donald

Trump seems to acknowledge that things are not going his way and he is being Trump: blaming others. The system is rigged according to the Republican nominee. He said he hears it from more and more people. Here is a quote:

I’m telling you, November 8th, we’d better be careful because that election is going to be rigged,” Trump said. “And I hope the Republicans are watching closely or it’s going to be taken away from us.”

One of his advisers suggests they should prepare for an “illegitimate outcome”. Roger Stone said: “The government will be shut down if they attempt to steal this and swear Hillary in. No, we will not stand for it. We will not stand for it”.

You don’t look for someone to blame when you are winning. Trump may realise his potential loss.

Markets love certainty and Trump is nothing but. If we do believe his statements on trade, the outcome is not market friendly. He will try to get better deals and will enact populist measures. And if he surprises with thin-skin responses on a daily basis, uncertainty could be much higher than changes to trade deals.

Isolationism in its various forms could tip the fragile US and global economies back down. China continues slowing down, Europe hasn’t solved its problems and Brexit is still looming.

Clinton Continuation

If Clinton consolidates her lead, this could provide a sigh of relief for markets. While markets usually prefer a Republican, pro-markets candidate, they may find comfort in Clinton. The Democratic nominee has been in the public eye for long decades and her entrance into the White House will be a continuation of Obama’s policies. And while she backtracked on her support for free trade agreements due to Sanders’ influence, she may take the walk back once again.

She backtracked on her support for free trade agreements due to influence by her primaries’ opponent Bernie Sanders. However, the same Sanders has criticized her for being too cozy with Wall Street due to the top-dollar speeches she gave to bankers. So, she may change her mind again after the dust settles on her inauguration and Sanders supporters return to political inactivity.

Ryan or Romney instead of Trump?

If things further deteriorate in both the polls and also in Trump’s statements, one cannot rule out the option for last minute Hail Mary substitution. Trump could quit while blaming all the world. He might want to avoid the humiliation of being a big loser and place the blame elsewhere. The Republicans could also find some character and dump Trump.

A voluntary departure of Trump of could result in a rush to nominate someone else. They could place a crowd pleaser such as former presidential candidate Mitt Romney or his VP pick Paul Ryan. Both remain senior figures. They could also opt for runner-up Ted Cruz.

Such a scenario, which currently seems farfetched could turn into reality. In this case, markets would probably prefer the Republican replacement for Clinton. In any case, the level of disruption from either candidate would be low.

What do you think?

The currency pair to watch will be USD/JPY. The yen could weaken on hopes for a mainstream outcome while it could fall on safe haven flows with growing chances of a Trump presidency.

Clinton Continuation vs. Donald Disruption – what the race means for currencies