The Bank of England convenes in a highly anticipated event. This is Super Thursday and now is the time to act, especially post-Brexit. But is a move already priced in?

Here is their view, courtesy of eFXnews:

GBP Ahead Of ‘A Very Dovish’ BoE: 3 Things To Expect – Goldman Sachs

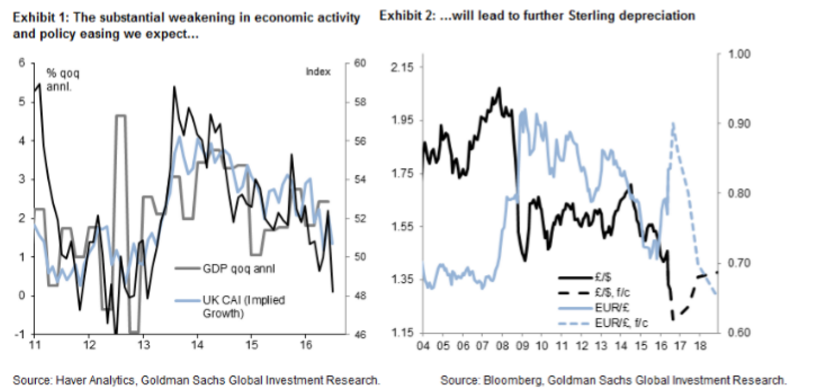

This week, the focus is on the Bank of England’s policy meeting and on Sterling’s reaction to the announcement of what we expect to be a substantial easing package.

Ahead of a substantial easing package from the BoE: Our UK economist Andrew Benito expects: (i) a 25bp cut to Bank Rate, with a 30% probability that the BoE cuts Bank Rate by 40bp, (ii) the announcement of £100bn of purchases of government and corporate bonds, distributed over a period of 6-months, and (iii) a very dovish MPC significantly downgrading UK growth and providing forward guidance on the future path of policy.

While the rate cut is fully discounted in the forwards, we think there is scope for the currency to weaken as the other elements of the policy package are announced and the BoE updates the economic and inflation outlook. An expansion of the asset purchase facility by £100bn, approximately equal to 10% of UK GDP on an annualised basis, would be a sizeable surprise relative to market consensus, which we estimate at around £50-75bn. While Sterling shorts are sizeable – a potential source of vulnerability to our view – we have showed that speculative positioning for the Pound historically has been a leading (not a contrarian) signal.

We expect more weakness in Sterling…: Sterling fell by about 11% in trade-weighted terms right after the vote on EU membership. But, contrary to our view of further weakness, the Pound has traded in a narrow range since the new government has been in office. Over the next 3- to 12-months, we are comfortable with our view that the slowdown in economic activity will drive the currency lower(we forecast £/$ at 1.20 and 1.25 and EUR/£ at 0.9 and 0.80 in 3- and 12-months, respectively).

BoE To Ease But Prefer To Stay Sidelined GBP For For Now – Danske

We expect the BoE to cut the Bank Rate by 25bp to 0.25% (0.50%). This is roughly in line with consensus (0.25%) and market pricing (a little more than a full cut is priced in). Moreover, we expect the BoE to restart its Asset Purchase Facility (APF) programme (QE) by buying sovereign bonds of an additional GBP75bn. Market expectations are already high: a 25bp rate cut is fully discounted and QE is also to some extent priced in.

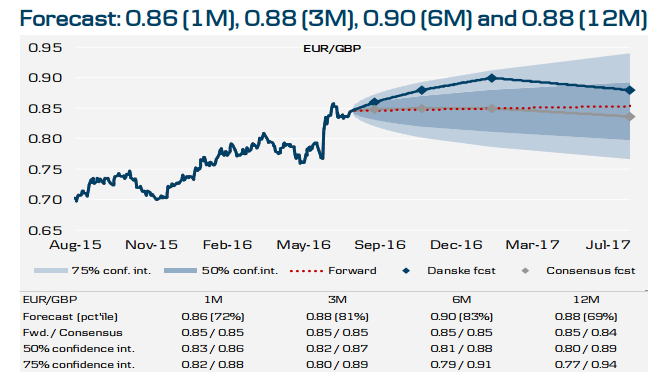

EUR/GBP outlook: −

We expect EUR/GBP to move higher on the announcement despite relatively high market expectations, as we expect the BoE to maintain a very dovish stance, which should help underpin market expectations of additional easing further down the road. We forecast EUR/GBP at 0.86 in 1M. − Over the medium term, we think that more GBP weakness is in store: we target 0.88 in 3M and 0.90 in 6M.

FX strategy: −

While we remain bearish on GBP, we prefer to stay sidelined in the near term as most of the expected BoE easing package seems to be priced in.

GBP: What Options Pricing Says About Risks For BoE/QIR? – Credit Agricole

We believe there is a lot of risk premium priced for the BoE/QIR this week. The forward implied overnight vol for the event is worth around 30 vols, this equates to around a 1.7 big figure move for the overnight ATM straddle.

We believe the MPC will struggle to exceed the already dovish market expectations and as such the options market likely reflects risks that the BoE will disappoint.

We expect the BoE to deliver a 25bp cut and given the BoE’s comments at the July meeting, it would be difficult for the Bank to not deliver some form of stimulus, as such options pricing is perhaps a little elevated.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.