The traditional relationship between central bank easing and price action response, whereby easing measures translate into currency weakness, has been thoroughly challenged this year with a series of central bank easing announcements largely dismissed by markets.

Guest post by James Harte of Orbex

Quick Timeline

- The BOJ cut rates into negative territory, for the first time in domestic history, in January and despite initial weakness on the day, JPY has rallied since

- The ECB announced a wave of easing measures in March, cutting all three rates and expanding QE and again, despite initial weakness, EUR rallied to close the day nearly 200 pips higher and proceed to rally further over the following month.

- The RBNZ cut rates in March and the NZDUSD now sits roughly 600 pips higher than it was on the day of the rate cut

- The RBA cut rates in May and whilst some weakness manifested in the following weakness, buying quickly kicked back in and took AUD above the pre-cut level.

- The BOJ announced further easing measures in August with an expansion of their ETF purchase program from Y3trln to Y6trln and once again, JPY was heavily bid.

- The RBA then cut rates by a further 25bps in August and despite some initial weakness overnight, losses were immediately reversed shortly after the London open the following day.

- Finally, last week we saw the Bank of England launch one of the more successful easing initiatives with the announcement of easing across all four channels spurring a sharp sell-off in GBP. However, GBP has not yet fallen against the Dollar to the extent that t fell after the bank’s July meeting.

Why Has The Relationship Broken Down?

To consider the reasons behind the dwindling efficacy of these policies we need to first of all look at how these policies are intended to work which is to drive down bond yields. Historically easing measures caused two reactions that translated into currency weakness; the first being a surge in inflation expectations and the second being increased expectations of further easing (such as deeper rate cuts or more QE) driven by forward guidance which helped keep bond yields and currencies further pressured.

The challenge now faced by central banks using the bond channel is that as bond yields are so low now that there is an inherent limit in terms of how much more of a reduction they can achieve. The primary method for lowering bond yields has been a reduction in the policy rate which lowers the cost of funding. However, with policy rates similarly so low, and indeed negative in some regions, it is difficult for banks to lower rates further and even harder to achieve meaningful downside impact.

Negative Yields Limit Currency Impact

A good example is Japan where the yield curve, up to 10 years out, sits below 0, suggesting the failed impact of easing measures on long-term yields. The same is true for Switzerland which explains the difficulty the SNB are having in keeping the Swiss Franc down. The EuroZone yield curve, whilst not negative yet, is not far off and again suggests that the ECB will struggle to meaningfully impact the Euro lower. Furthermore, these particular regions each have currency account surpluses and during a time of thinning investment returns, the rise in local savings can be expected to keep bond yields pressure. These currencies are likely to continue to struggle without an increase in inflation expectations, fuelling higher global risk appetite, driving more investment abroad.

Credibility In Question

The issue of credibility plays a key role in determining the efficacy of central bank easing policies. In the post-GFC world where central banks have been cutting rates and implementing QE for nearly 10 years, there is an argument now that markets have simply lost faith in the power of these measures to meaningfully contribute to economic growth.

Again, Japan is the standout example with official interventions and easing measures belying the consistently falling inflation and inflation expectations which plague the region. Indeed, examining the reasons behind the tide of JPY weakness over 2014 shows that beyond a rise in inflation expectations, and lowering yield, the key driver was capital outflow due to the GPIF (Japan’s largest pension fund) announcing that it was moving more of its investment overseas. In this instance, JPY weakened because the outflows were done on an FX-unhedged basis. However, currently, the GPIF (as well as other funds) have been hedging their FX exposure due to a shift in sentiment which no longer anticipates further JPY weakening.

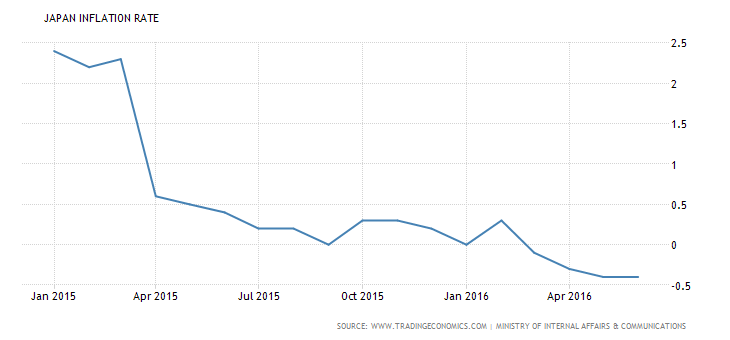

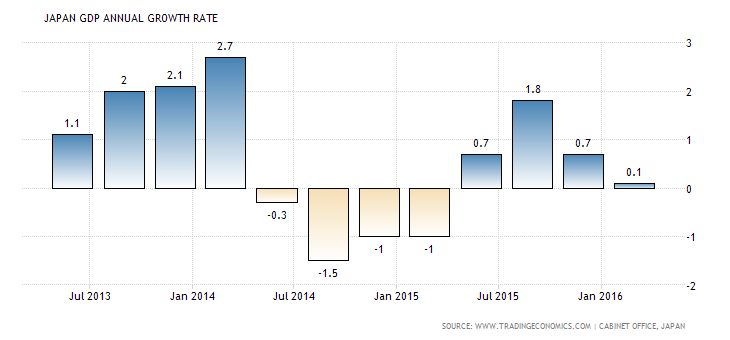

Indeed, Japanese vast QE programme has failed to achieve the bank’s 2% inflation target and far from moving in the right direction, domestic inflation has been in free-fall over the last year sliding from over 2% to -0.4%. Alongside these dismal inflation readings, annual growth has continued to decline, currently standing at just 0.1%.

EURUSD Ignores ECB

More than a year since the ECB announced its huge EUR 1trln QE programme, with both inflation and growth in the EuroZone remaining heavily subdued, the bank was forced once again to roll out fresh easing measures in March this year, cutting rates further and expanding QE by EUR 20 bln a month. With the news being met, once again, by a surging Euro, ECB’s Draghi noted that the ECB was no longer targeting a weaker exchange rate and was instead focusing on fuelling domestic demand. This sentiment is perhaps expressing the ECB’s admission of their inability to drive the currency lower.

Near six months on from this latest easing, markets now anticipate further easing to be announced at the bank’s September meeting. The first tentative signs of a recovery in inflation, which has been rising over recent months, now risks being jeopardized by the economic fall-out of Britain’s vote to leave the EU which is likely to see the Bank revise its inflation forecasts lower.

Central Banks Fighting Expectations

One undeniable aspect of the recent failure on behalf of central banks to drive currency weakness has been the level of expectation in the market. With central banks forced to clearly signal their intention to ease, players are able to comfortably anticipate easing measures and position accordingly, leading to a lack of impact from the actual announcement. This has become a frustrating dynamic for central banks to contend with and any perceived failure to “satisfy” the expectations of the market have led to violent repercussions (e.g., ECB Dec 15 and BOJ July 16).

Traditionally, verbal intervention in lieu of actual easing has been a useful tool for central banks looking to buy themselves more time, however, this avenue is now reaching its limits with markets either dismissing the sincerity of such sentiment or indeed, the effectiveness of their implementation.

The Demise Of The Macro Trade

The lack of trend in EURUSD and AUDUSD, despite the Fed having raised rates and ECB and RBA having continued to ease, emphasises the complications facing macro traders with strategies based on interest rate differentials and central bank policy expectations offering negative returns in 2016. With these elements having slipped from the podium of market drivers, traders are now turning to areas such as valuations, fiscal policy, and non-monetary policy to understand currency flows.

Looking Ahead

The Reserve Bank of New Zealand is the next to stand in the spotlight with their upcoming August rates meeting on. The bank is widely expected to cut rates by a further 25bps with some analysts suggesting that the bank will even go as far as cutting rates by 50bps in a bid to boost inflation, which currently sits just off 10 year lows, and dampen NZD. Indeed, having watched the failure of their Australian counterparts last week, the RBNZ will be wary of falling into a similar trap.

However, the RBNZ also faces the challenge of trying quell a soaring housing market and further easing runs the risk of providing more fuel. With expectations of a 25bps cut now the consensus call, there is a severe risk of the RBNZ suffering and adverse reaction if it merely meets these expectations.

About James Harte

With over 6 years’ experience analysing currency markets, James is now a well-known industry analyst focusing on price action trading and fundamental drivers. Beginning as a private retail trader, James developed a strong interest in understanding the fundamental aspect of the market before pursuing technical trading capabilities which he now uses to identify opportunities over a short-term horizon. Alongside his market experience James is also IMC certified having achieved the qualification to help further his understanding not only of the markets but the industry as a whole.