The RBNZ makes its move today and everybody expects a cut. Is it already priced in? Probably. But the RBNZ could go further down the rabbit hole:

Here is their view, courtesy of eFXnews:

RBNZ Would Need To Cut Rates By 50bp To Move NZD Significantly Lower – Westpac

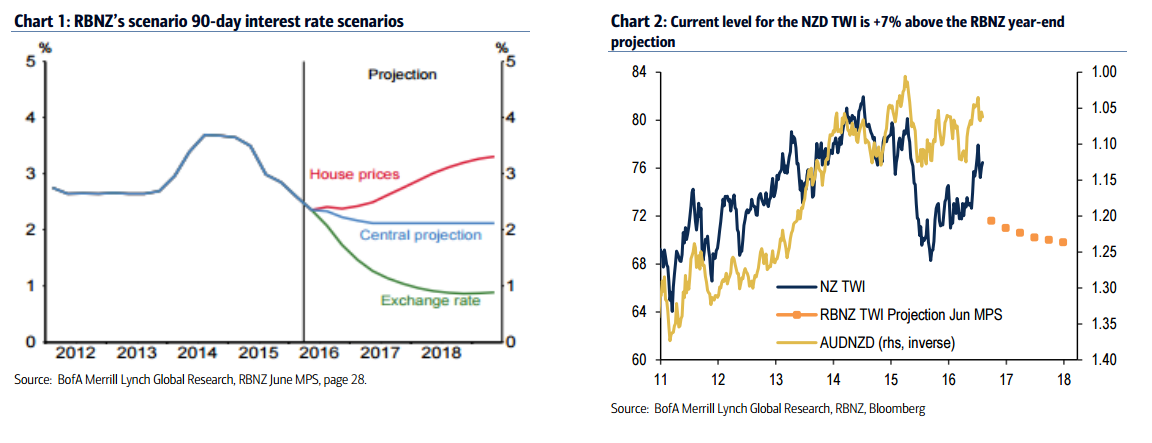

We expect the RBNZ to cut the OCR by 25bp to 2.0% at Thursday’s Monetary Policy Statement, and to signal further easing via both the policy paragraph and a 30bp reduction in its interest rate projection. This outcome would be market neutral. We assign a 60% chance to such a scenario, which markets have more than fully priced. Indeed, there may be slight disappointment given August OIS is trading at 1.98% as we write.

To move the NZD significantly lower, the RBNZ would need to lower the interest rate track by around 50bp. In this scenario (a 25% chance we think), NZD/USD would fall by 1c and the 2yr swap rate by around 10bp. An extremely dovish scenario would see the RBNZ cutting by 50bp. That would push NZD/USD 2c lower, and 2yr swaps around 20bp lower. However we see less than a 10% chance of that.

NZD Into RBNZ: Is There A Case For A 50bp Rate Cut? – BofA Merrill

A 25bp cut this week is almost certain.

There might be some push back at some of the major global central banks to extend monetary policy into negative territory as focus shifts to fiscal policy, but monetary policy in the antipodes still has some way to go. The Reserve Bank of Australia (RBA) cut rates last week (-25bp to 1.50%) and the Reserve Bank of New Zealand (RBNZ) is almost certain, in our view, to cut rates by 25bp to 2.0% this week.

A more extended easing cycle.

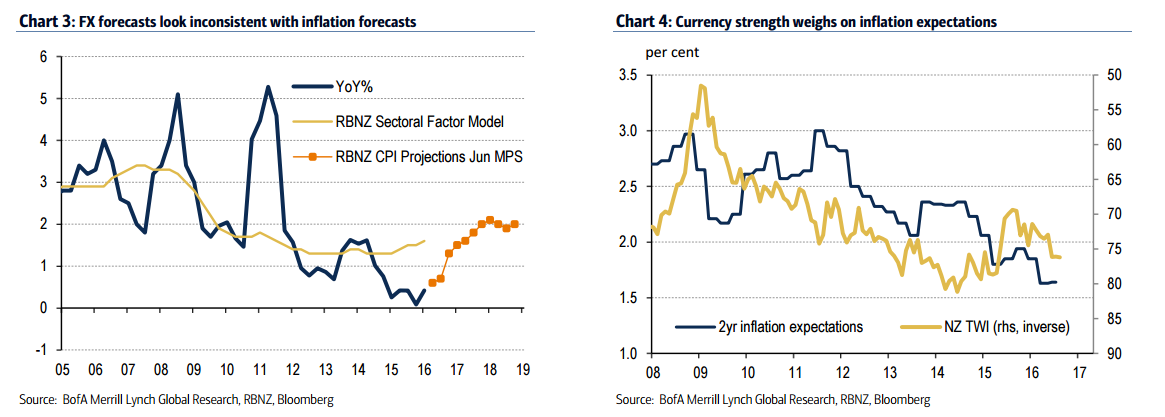

We see more scope for an extended RBNZ easing cycle over coming months in light of the strength of NZD relative to RBNZ forecasts. The Bank has announced plans to further reign in investor lending to housing. This should open the way for easier policy to generate easier financial conditions. In contrast, higher bulk commodity prices give the RBA more reason to be relaxed about current levels for the AUD. The RBNZ has been more explicit about the need for a weaker NZD. It will have to act more aggressively so expect some relatively large adjustments to forecasts and market guidance.

The case for a 50bp cut So why not cut more at this meeting?

It is a non-trivial risk, but in our view it is a weak case at this point. We believe a 50bp cut could signal panic even before the new housing measures have been put into place. Consultations on the LVR restrictions end the day before the policy meeting this week, although RBNZ has instructed banks to act in the spirit of these restrictions immediately (to avert a rush to beat new guidelines). They would need some time to assess their traction. The economy also appears to retain solid momentum at this stage with notable strength in the housing sector as a result of the rate cut earlier this year and the impact of putting tighter measures on the Auckland market on other parts of the country. New construction will continue to underpin growth.

FX – one cut may not be enough but a deeper easing cycle could be

Despite its depreciation following dovish RBNZ commentary in July, the NZD remains at an elevated level compared to recent history. While a 25bp rate cut may not be sufficient to materially weaken the NZD in the face of strong carry-seeking flows, it seems necessary to keep monetary conditions at a stable level. The New Zealand economy might not warrant significantly looser monetary policy just yet, but neither can it afford much tighter monetary conditions due to the exchange rate. At the same time, it is worth noting that the three-month carry-to-implied volatility ratio for NZD/USD is already close to the lows seen during the global financial crisis. The relentless search for positive yield may continue, but an erosion of NZD’s volatility-adjusted carry to fresh lows may be more of an impediment to appreciation than currently assumed. A sufficiently large cut to the RBNZ’s Bank Bill forecast could yet weaken the NZD further especially relative to the AUD, where it would contrast with a more stable outlook for the policy rate

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.