The Reserve Bank of New Zealand’s monetary policy meeting last week saw the central bank cut the OCR by 25 basis points to 2.00%, a new record low and on par with other major central bank policies across the developed economies.

The RBNZ’s monetary policy decision also highlighted the fact that central bank policy decisions and the subsequent impact following rate cuts have done little to stem the appreciation in the exchange rates, especially when policies targeting exchange rate were used. The monetary policies so far this year has, in fact, had the opposite effect on exchange rates, which in theory should have seen a lower rate following a looser monetary policy, but that hasn’t been the case.

On Wednesday, the New Zealand dollar surged despite a rate cut and a dovish statement from the RBNZ indicating that further easing was to come in the upcoming meetings. The market reaction mirrors that of the BoJ’s policies witnessed earlier this year, which instead of sparking a weaker yen saw the currency appreciate sharply. The AUD is no exception to the case either as the Australian dollar remains trading near this year’s highs of $0.76, despite the RBA cutting interest rates twice this year.

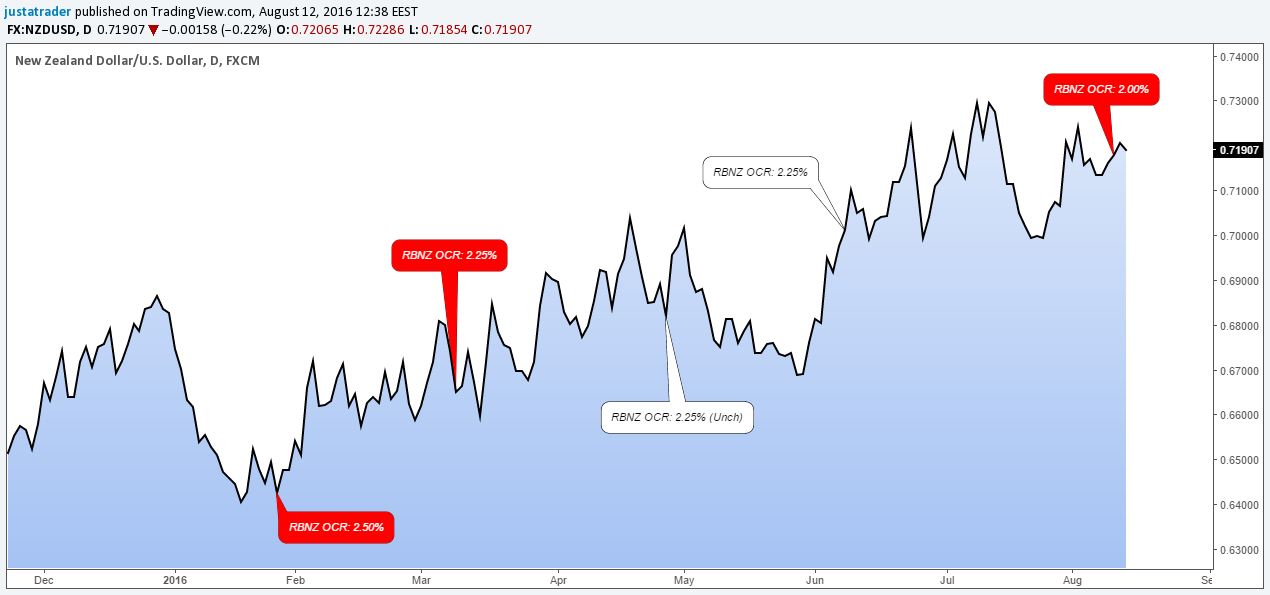

NZD appreciates despite three rate cuts this year

The New Zealand dollar has been steadily appreciating, for the most part, this year. The RBNZ cut interest rates in January this year followed by a second rate cut in March and the most recent rate cut on August 11th. However, as the chart below shows the New Zealand dollar has been steadily rising instead of weakening, despite repeated calls for depreciation in exchange rates by the RBNZ.

RBNZ Rate Cuts, 2016

At the policy meeting last week, the RBNZ noted that the higher exchange rate has been stifling inflation and called for a weaker currency as the monetary policy meeting stated that “Weak global conditions and low interest rates relative to New Zealand are placing upward pressure on the New Zealand dollar exchange rate. The trade-weighted exchange rate is significantly higher than assumed in the June Statement. The high exchange rate is adding further pressure to the export and import-competing sectors and, together with low global inflation, is causing negative inflation in the tradables sector. This makes it difficult for the Bank to meet its inflation objective. A decline in the exchange rate is needed.”

Higher bond yields from Australia & New Zealand

With investors facing smaller possibilities when it comes to yield chasing and central bank bond buying keeping yields lower, currencies such as the Australia and New Zealand dollar have remained resilient largely because the interest rates in the respective economies are still high.

J.P. Morgan fund managers note that “interest rates are still positive in these countries, despite rate cuts. That makes their debt more attractive for return-hungry investors faced with a growing pool of negative-yielding government bonds — $8.8 trillion, or just under one-third of all outstanding government bonds,” echoing similar views from other fund managers.

William De Vijlder from BNP Paribas says, “interest rates are stuck at similar levels around zero, it is harder than ever for central banks to manage the value of their currencies.”

| Country | Bond Yields, 10 year |

| New Zealand | 2.16% |

| Australia | 1.91% |

| Germany | -0.08% |

| UK | 0.54% |

| US | 1.54% |

| Japan | -0.10% |

10 Year Bond Yields

Weaker US dollar

Another piece of the puzzle has been the US dollar itself, which has remained flat for most of this year. This is partly due to the fact that the Fed’s communication on forward guidance has remained somewhat guarded. The US economic growth has slowed with the first quarter real GDP rising only 0.80%, while the second quarter GDP, according to initial estimates has increased only 1.20%, which has been one of the slowest paces of increases in recent years. With the markets scaling back expectations on the pace of rate hikes, the US dollar has remained somewhat weaker which has helped currencies such as the AUD, NZD and even the JPY to gain ground against the greenback.

Last week saw a series of weak economic data from the US which has kept the US dollar fairly range bound. Looking ahead, the US consumer inflation data and the FOMC meeting minutes will be the key events to focus on. For the moment, there is still a possibility that the Fed could hike in September, but the markets are not quite sold on this idea just as yet. From New Zealand, the quarterly unemployment rate will be closely watched as well, as continued upbeat economic data could keep NZDUSD supported to the upside.