The Canadian dollar enjoyed the rising price of oil but this may not last too long. Here is an outlook from BofA:

Here is their view, courtesy of eFXnews:

We have maintained our CAD negative view although it has rallied a little in the past few days on the back of stronger oil. We continue to expect CAD to be on the weaker side into the mid 1.30s over the remainder of the year.

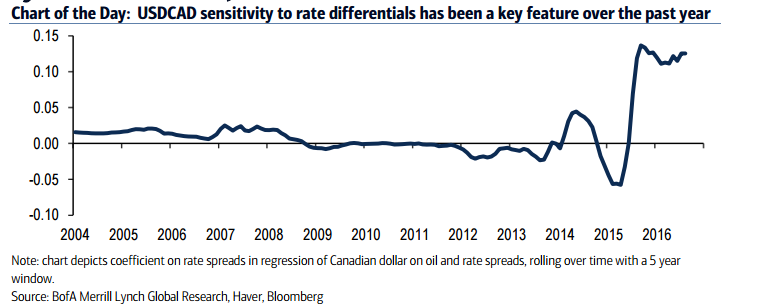

Our estimates of rough fair value continue to imply USDCAD should be modestly higher, but such estimates by themselves still constitute a fairly subjective look at the changing relationships between CAD and its core determinants, such as oil and other commodities. Both the sign and the magnitude of these relationships have been shifting around over the past several years. However, the relationship between CAD and rate differentials should be the key focus in our view, especially over the past year.

The connection is still not completely robust but feels consistent to us regarding how CAD has behaved in recent years and the importance of both BOC and Fed on currency markets. Consequently, with a BOC likely on hold and a Fed hiking in our view, USDCAD should see some upside.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.