The British Pound bounced versus the USDollar right at the post-Brexit lows last week but is this recovery does not mean it´s out of the woods just yet.

The volatility that brought theBrexit vote has evaporated with the GBP/USD returning to its usual average daily range of about 100 pips.

Talks of Article 50 not being triggered until April 2017 has had an inmediate bullish impact on the pound.

Prime Minister Theresa May said that article 50 must be triggered in the early part of 2017 (around April) ahead of France and Germany´s elections. Before this statement talks were that article 50 would be triggered by the end of 2017. This brought some buying pressure on the Pound at key levels against the USDollar. The GBP/USD had broken with a paramount psychological level again: the 1.3000 and was trading below 1.2900.

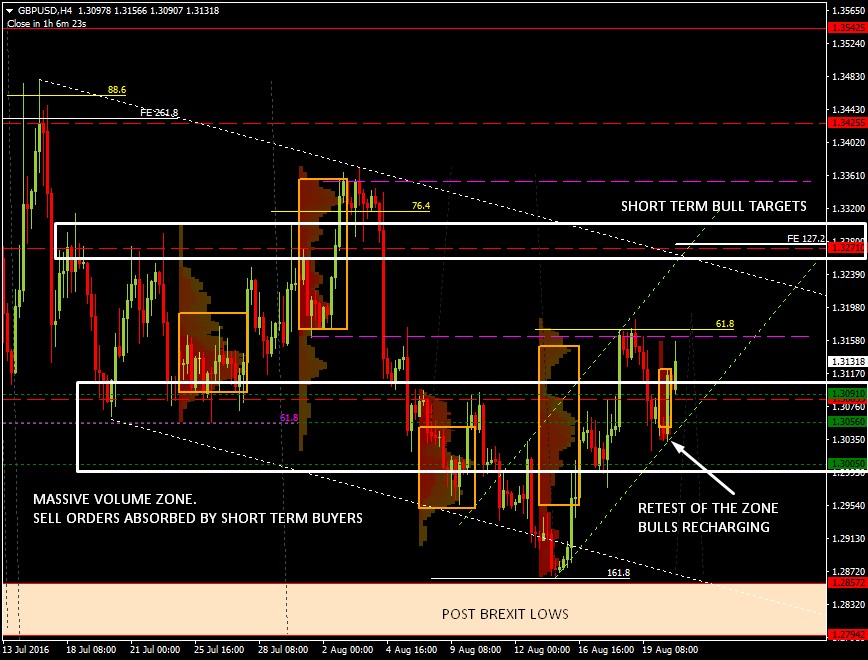

Price has now broken with the 1.3000 / 1.3090 level, an area of massive volume and its trading inside a bullish structure (green) inside the longer term bearish structure (white). looking like a bear flag the more it trades inside of it. We remain bearish on this currency pair, but we are flat for the time being. The first long targets are around the 1.3271 and the 127.2% expansion. Here is where we will look for bear setups, volume, and rejections.

Before we get there price needs to break with the 1.3760 level and the 61.8% of the last leg down. This level has been rejected firmly in the past but because of the break of the 1.3000 / 1.3090 zone we think short term bulls might push the price to the 1.272 expansion.

We are still looking for a break of the post-Brexit lows in the mid / long term.