The pound enjoyed the strong retail sales report as well as other useful data points to rally, but never went too far. With markets positioned against it, will it fall? Here is the view from CIBC and Scotiabank:

Here is their view, courtesy of eFXnews:

GBP: Fade The Bounce On Last Week’s Positive Data Surprises – CIBC

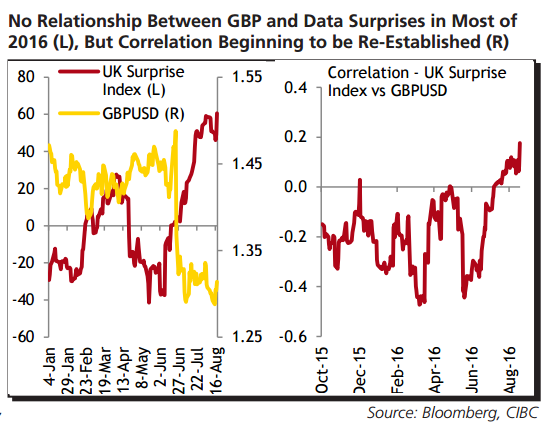

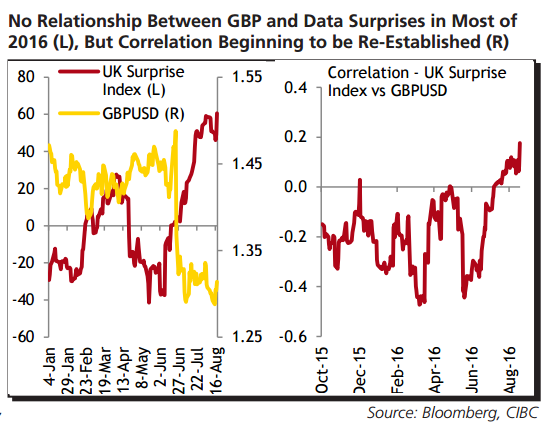

Throughout most of this year and much of 2015 as well, movements in sterling have been uncorrelated with surprises in economic data. With investors focused more on the Brexit polls in the lead up to the referendum, and what the Bank of England’s response would be after the fact, trends in the economic data have been largely overlooked. That appears to be changing, with markets now watching to see if the data flow justifies the monetary response or even prompts more.

As such the surprisingly positive claimant count unemployment and retail sales figures for July acted as a support for Sterling last week.

However, we think it’s just a matter of time before we see some weakening in the data, and expect GBPUSD to fall back towards the mid 1.20’s.

IMM Report: Investors Added To Record GBP Shorts, Pared EUR Shorts, Piled On JPY Longs

Data in this report cover up to Tuesday, August 16 & were released Friday, August 19.

This week’s FX positioning data from the CFTC for the week through August 16th showed investors picked up where they left off in the prior week’s data—adding to GBP net short positions. Net GBP shorts edged out to a record for a third consecutive week, rising by 4k contracts, or a little more than USD360mn, to total 94k contracts (USD7.7bn). As price action this week has shown, relatively extreme positioning leave the market susceptible to short, sharp positioning-driven corrections. We suspect, however, that broader GBP bearishness will persist, not least because the BoE has indicated that it expects the weak exchange rate to facilitate the economic adjustment after Brexit.

Overall, the aggregate market bull bet on the USD dropped for a third week running, however, falling USD1.5bn to total USD11.1bn.Investors pared net EUR shorts quite sharply (USD630mn) and piled on net JPY longs (USD988mn) as the USD retested JPY100; net JPY longs neared USD7bn (56k contracts) last week but remain shy of peak levels seen in April (USD8.2bn).

Elsewhere, speculative players boosted net long AUD positions by USD490mn (up 6k contracts equivalent) but kept net exposure to the NZD neutral. Positioning in the CAD remains somewhat erratic relative to market movement; in the week through August 16th, investors cut back on the net long CAD exposure (by USD200mn) to near the lowest level in a year—just as the CAD strengthened. IMM positioning appears to have been at odds with the broader movement in the CAD since April.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.