The Australian dollar had its flirt with the upside but never went too far. What’s next? Here are two opinions about the next moves and the RBA’s role:

Here is their view, courtesy of eFXnews:

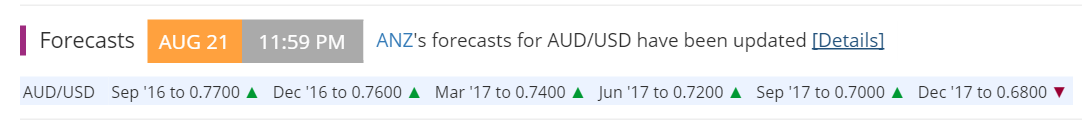

AUD Will Peak At 0.78 In Q3 Before Reversing Gradually Lower: How To Trade It? – ANZ

We forecast that the AUD will peak at USD0.78 in Q3 2016. While our projections show a gradual depreciation from there, we expect that AUD will trade with some volatility in a USD0.70- 0.78 range before breaking lower in the latter half of 2017.

Given the uncertain nature of the timing of the depreciation, the current low level of volatility, and the skew present in the risk reversal, we recommend using options to capture this range. We recommend buying a six month AUD/USD0.74/0.71 put spread and selling a six month AUD/USD0.80 call at an indicative rate of AUD 24 pips.

RBA On Hold For Rest Of The Year Unless AUD Appreciates Significantly – Barclays

The July jobs report showed that total employment increased 26.2k, and the unemployment rate declined to 5.7%, slightly better than expected. However, the report showed a stark difference between full-time jobs, which fell sharply (-45.4k), and part-time employment, which increased significantly (+71.6k). Following the release of the data, there was no material change in the expectations for rate cuts, while AUDUSD continued to trade in a tight range of 0.76-0.77. The July job report may raise some minor concerns about the strength of the labour market, but we think the reduction in the unemployment rate will still be seen as a sign of ongoing jobs growth.

In the minutes released earlier last week, the RBA noted that economic parameters were moving broadly in line with the expected trajectory. Markets are now pricing in a 48% chance of the RBA moving at its November policy meeting; however, we believe there is no clear path for rate cuts in 2016, given that the inflation and growth dynamics remain similar to the RBA’s previous assessment.

While the central bank retains an easing bias, we think its next move will depend on inflation dynamics. Australia’s economic outlook remains resilient to external shocks, and unless there is significant AUD appreciation, we believe there will be no urgency to ease further. Moreover, with the July labor market data indicating an overall improvement in job creation, we expect the RBA to stay on hold through 2016.

This week will be extremely light terms of data releases for the Antipodeans. Markets will gauge the tone of Chair Yellen’s speech at Jackson Hole for directions of the AUD and NZD in the following week.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.