The dollar rallied on Yellen’s Jackson Hole speech and the consequent comments by Fischer and the upcoming Friday became much more important. Will the NFP justify a rate hike on September 22bnd? Here are two opposing opinions:

Here is their view, courtesy of eFXnews:

This Week’s NFP Data To Reinforce Our Fed Call For A September Hike – BNPP

Fed Chair Yellen delivered the hawkish message we were looking for on Friday, telling her Jackson Hole audience that the case for raising rates has strengthened recently. It took follow-up comments from Vice Chair Fischer later in the morning to generate a meaningful adjustment higher in rates and the dollar though.

Our expectation is that the hawkish message from Fed Chair Yellen last week will pave the way for a September hike, which should help the USD recover some ground.

We expect the data will actually reinforce rate hike expectations. Our economists expect Friday’s employment report to show robust payroll growth of 215k, which will put 3m average job growth at a powerful pace of 254k. Indeed, given strength in the last two reports, even a 125k result on Friday would leave the 3m average running at 224k. Our position metrics suggest USD positioning was short heading into the speech.

We remain positioned via derivatives for a limited recovery in the USD versus the EUR, JPY, GBP and AUD. However, we do not expect the Fed to signal or embark on a series of rate hikes, which should limit the extent to which US real yields can recover from current low levels.

Here Is Why August Jobs Data Would Fall Short Of Fed’s Criteria For A September Hike – RBS

In the wake of Jackson Hole, there is little doubt that the timing of Fed action will be determined by the data. According to the minutes from the July FOMC meeting, some participants (including Yellen, presumably) preferred to delay action until they were confident inflation was moving closer to 2% “on a sustained basis” and until the data gave them greater confidence that economic growth was “strong enough to withstand a possible downward shock to demand.” The August employment data, while healthy, may fall short of that criteria on both fronts.

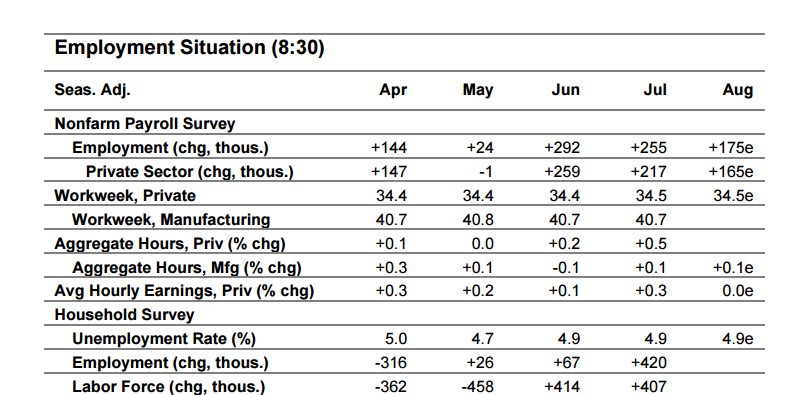

First, following hefty increases in each of the prior two months, we look for job growth to have settled back a bit in August, with overall payrolls forecast to have advanced by 175,000 (private payrolls may have risen by 165,000). Looking through the month-to-month volatility, the trend (12-month moving average) in payroll growth has decelerated from over 250,000 in early 2015 and 230,000 in early 2016 to around 200,000 currently. Such a cooling is not uncommon late in the economic cycle. Moreover, the current pace is still more than sufficient to offset the growth in the labor force, keeping downward pressure on the unemployment rate. However, the deceleration does suggest less upside momentum which, all else equal, might make the economy more vulnerable to a negative external shock.

On the inflation front, the news in the employment report may also make the case for near-term action look less compelling, since average hourly earnings in August are likely to have been biased lower by the calendar quirk (the reference week for the payroll survey ended on Saturday, August 13th; since the 15th of the month falls after the survey period, increases in bi-monthly pay are less likely to have been captured, skewing the result lower). In August, we expect average hourly earnings to have been flat, compared to an above-trend increase of 0.4% recorded in August 2015. Thus, on a year/year basis, the growth in average hourly earnings may have slid from 2.6% in July to perhaps 2.3%. Optically, this puts less pressure on the Fed to hike this month.

Away from payrolls and earnings, we look for the average workweek to have held steady (after extending in July). Combined with a more moderate private payroll advance, this would imply a rise in the index of aggregate hours worked of just 0.1% following a hefty 0.5% rise in July – another sign of some moderation in the expansion pace. Finally, we look for the unemployment rate in August to have remained steady at 4.9% for a third straight month.

On balance, then, while the August employment report may be healthy enough to keep the door open for rate hikes later this year, the results may not be strong enough to compel this risk-adverse Fed to act in September.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.