The US dollar was moving down during the first half of Friday’s trading session but reversed the losses after the surprisingly positive employment report. US non-farm payrolls climbed 255,000 in July, topping the forecast growth by 180,000 and the previous month’s increase by 292,000. Average hourly earnings grew 0.3%, faster than the 0.2% rate of growth predicted by experts and the June’s 0.1%. The only slightly negative indicator was the unemployment rate that … “Dollar Bounces as Non-Farm Payrolls Surprise Positively”

Month: August 2016

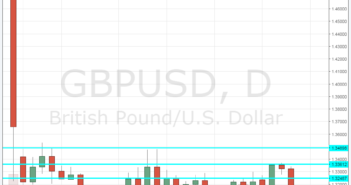

Potential for further GBP falls, not necessarily against USD

The massive BOE package announced on August 4th already hurt the pound, but there could be more in store. Here are opinions about other opportunities. More BoE Easing In November; EUR/GBP En-Route To 0.90 – Danske As expected the Bank of England (BoE) delivered a substantial easing package today, including a 25bp Bank Rate cut … “Potential for further GBP falls, not necessarily against USD”

Sterling Recovers Following Plunge on BoE Stimulus

The Great Britain pound is recovering today after yesterday’s drop that followed the announcement of additional stimulus package from the Bank of England. Yesterday, the sterling has plunged as the BoE unwrapped a huge stimulus package that included an interest rate cut and expansion of the asset purchase program. Furthermore, the central bank confirmed likelihood of additional monetary easing in the future. Yet it looks like with the recent aggressive selling the pound has … “Sterling Recovers Following Plunge on BoE Stimulus”

Australian Dollar Rises After RBA Statement & Construction Index

The Australian dollar rose today, gaining on the euro for the fourth consecutive day, following the release of the Monetary Policy Statement from the Reserve Bank of Australian and the construction index from Australian Industry Group. The RBA was rather upbeat about economic growth in its statement, saying: While the prospects for growth in economic activity are positive, there is room for even stronger growth. At the same time, the central bank predicted that inflation would … “Australian Dollar Rises After RBA Statement & Construction Index”

Australian Dollar Higher Despite Lackluster Retail Sales

The Australian dollar moved higher during today’s trading session even though Australia’s retail sales missed analysts’ estimates. Retail sales rose by just 0.1% in June from May on a seasonally adjusted basis. Market participants were counting on at least 0.3% growth. The Aussie was rising despite the disappointing report but halted its rally after the Bank of England had announced its stimulus package. Nevertheless, the currency is … “Australian Dollar Higher Despite Lackluster Retail Sales”

USD/JPY: 5 Reasons To Stay Bearish; En-Route To 95 In

USD/JPY is under pressure after the light BOJ decision and the expected government stimulus. Some expect USD/JPY to hit 98 and here is a bolder call: Here is their view, courtesy of eFXnews: Our core argument has been that we did not believe the likelihood of the market seeing “helicopter money” was anything as high as … “USD/JPY: 5 Reasons To Stay Bearish; En-Route To 95 In”

3 reasons why GBP/USD could further fall and levels to

Carney caused carnage in GBP/USD, delivering a comprehensive, coherent and timely package to mitigate the effects of Brexit. Cable dropped 200 pips and returned to the lower range. However, when looking at the bigger picture, we are still above support. Here is why there is more room to the downside and what levels to watch. … “3 reasons why GBP/USD could further fall and levels to”

Pound Down as BoE Steps in with Expanded Stimulus

The Great Britain pound dropped today after the Bank of England cut its interest rates, expanded its stimulus program, and lowered the growth forecast. The BoE made a big announcement of additional stimulus package today: At its meeting ending 3 August 2016, the MPC voted for a package of measures designed to provide additional support to growth and to achieve a sustainable return of inflation to the target. This package comprises: a 25 basis point … “Pound Down as BoE Steps in with Expanded Stimulus”

EUR/USD: Trading the US Nonfarm Employment Change

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background Job … “EUR/USD: Trading the US Nonfarm Employment Change”

Will the BOE bury the GBP or is a bounce

The Bank of England convenes in a highly anticipated event. This is Super Thursday and now is the time to act, especially post-Brexit. But is a move already priced in? Here is their view, courtesy of eFXnews: GBP Ahead Of ‘A Very Dovish’ BoE: 3 Things To Expect – Goldman Sachs This week, the focus … “Will the BOE bury the GBP or is a bounce”