The Australian dollar opened sharply lower against the US dollar and the euro at the start of this week’s trading, but as of now the currency is attempting to regain its footing. Fed Vice Chairman Stanley Fischer said on Sunday that the US central bank is close to reaching its inflation and jobs targets. His comments added to last week’s remarks from other members of the Federal Reserve that were for the most part hawkish. … “Australian Dollar Firms After Opening Sharply Lower”

Month: August 2016

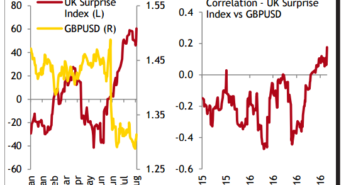

GBP: With record shorts and a failed upwards move –

The pound enjoyed the strong retail sales report as well as other useful data points to rally, but never went too far. With markets positioned against it, will it fall? Here is the view from CIBC and Scotiabank: Here is their view, courtesy of eFXnews: GBP: Fade The Bounce On Last Week’s Positive Data Surprises – … “GBP: With record shorts and a failed upwards move –”

2 reasons not to get caught up in USD bearishness

While some expect the weakness of the USD to continue, the team at Goldman Sachs has different views for the greenback. Here is their view, courtesy of eFXnews: We believe the current level of anxiety over the Dollar is overdone for two reasons. First, Exhibit 1 shows the path of trade-weighted USD versus the majors since … “2 reasons not to get caught up in USD bearishness”

Week Ends with Losses for US Dollar as Policy Outlook Mixed

The US dollar continued to be driven mostly by monetary policy outlook during the past trading week. Unfortunately for the currency, the outlook was not particularly supportive, though it has changed a bit by the weekend. The dollar was rather soft for the most part of the week as most market participants remained skeptical about chances for the Federal Reserve to continue monetary tightening in the near future. Fed minutes released during the week were not helping … “Week Ends with Losses for US Dollar as Policy Outlook Mixed”

Pound Ends Friday with Losses

The Great Britain pound ended Friday with losses amid speculations that the United Kingdom may start the process of leaving the European Union in the first half of 2017, ahead of the important elections in Germany and France. Previously, many market participants were thinking that it would take a long time for Great Britain to start legal procedures for exiting the EU. Yet there were reports that UK Prime Minister Theresa May … “Pound Ends Friday with Losses”

Talks About Fed Tightening Buoy US Dollar

The US dollar bounced today, rising for the first day in six against the US dollar, as traders continued to speculate about prospects for an interest rate hike from the Federal Reserve. John Williams, San Francisco Fed President, added his voice to the chorus of policy makers who want to continue monetary tightening sooner rather than later. He said yesterday: In the context of a strong domestic economy with good momentum, it makes … “Talks About Fed Tightening Buoy US Dollar”

Polish Zloty Under Pressure from Monetary Easing Outlook

The Polish zloty fell against other most-traded currencies, including the US dollar, during the Friday’s trading session, pressed by expectations of monetary easing from the nation’s central bank. Voting member of the central bank Jerzy Zyzynski told Reuters today that he favors an interest rate cut: I would back cutting interest rates. When uncertainty was high, the MPC supported a policy of stabilising rates. Now, perhaps, uncertainty … “Polish Zloty Under Pressure from Monetary Easing Outlook”

Canadian Dollar Suffers from Disappointing CPI & Retail Sales

There were two important economic releases from Canada scheduled for today, the Consumer Price Index and retail sales, and both of them turned out to be disappointing. Unsurprisingly, the market reacted to the news by pushing the Canadian dollar lower. Canadian retail sales fell 0.1% in June while core components (retail sales excluding motor vehicle and parts dealers) were down 0.8%. Forecasters had promised growth for both indicators. The CPI … “Canadian Dollar Suffers from Disappointing CPI & Retail Sales”

Canadian Dollar Little Changed After Thursday’s Rally

The Canadian dollar was little changed at the start of the Friday’s trading session after rallying against the US dollar and the Japanese yen on Thursday. The rally was caused by the rise of crude oil prices. The Canadian currency continues to follow moves of crude oil. Fortunately for the loonie, oil prices were moving up on Thursday, lifting the currency along with the them. Crude was rising on speculations about possible output cap by major oil producing … “Canadian Dollar Little Changed After Thursday’s Rally”

Dollar Remains Vulnerable After Fed Minutes

The US dollar remained weak today, falling for the fifth straight day against the euro, as the minutes released by the Federal Reserve continued to weigh on the greenback. The minutes were rather hawkish, with one member even voting to raise interest rates in July. Yet markets were not happy with what they have seen and did not share the optimism of US policy makers. William Dudley, New York Fed President, who … “Dollar Remains Vulnerable After Fed Minutes”